Yield Curve Reinverts, Yes This Is Normal, And A Note On Silver If The Dollar Is Honestly Revalued To Gold

And Bitcoin is in trouble again.

Bitcoin Falling vs Gold, Triple Top from 2021 Holds (So Far)

Bitcoin to gold just had what looks like a marginal failed break of a triple top. AKA bull trap reversal. I'm not even sure if that's the exact term, but from what little I know of technical patterns I think that's sort of what they call it. A triple top is a very bearish pattern on one hand, and a breakout from a triple top is very bullish. In the middle you have what we see here, a marginal break of the triple top, which sucks in dollars as traders follow the breakout, but there's no follow through, and then it breaks back down. That's arguably even more bearish than a straight-up triple top, because it sucked in sideline capital on the marginal breakout and that capital is no longer there to cushion the fall.

Bitcoin is an absolutely rabid wild animal so we can't say if this is it for the damn (non)thing, but right now the bitcoin maximalists like Saylor and Peter Schiff's son Spencer (may God have mercy on his youthful follies) are peeing themselves I guarantee you that. If you own a little bit for speculation that's fine, different story. I have never been against owning a small amount of bitcoin for fun, provided you do not get sucked in to the fantasy of the whole scam.

Bitcoin is now threatening to break back down below the 50WMA, and we know that liquidity is already running out. At the next (and final) dollar crunch, bitcoin will fall the hardest and the fastest of all major bubble assets.

Yield Curve Reinverting, Yes This is Normal

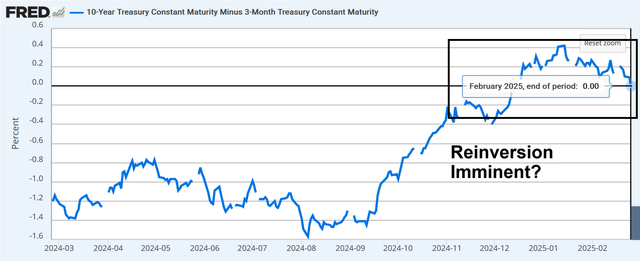

The 10Y3M yield curve spread is back to negative, meaning 3M yields are once again higher than 10Y yields. This has happened prior to every recession since 1978 preceded by a negative-to-positive yield spread. The chart below is a day old, we are now at negative 6bps.

You can see this happened in 1990 just prior to the 1990 recession.

Keep reading with a 7-day free trial

Subscribe to The End Game Investor to keep reading this post and get 7 days of free access to the full post archives.