Whitney's Second Mortgage Swan Song, And More Exact Yen Math

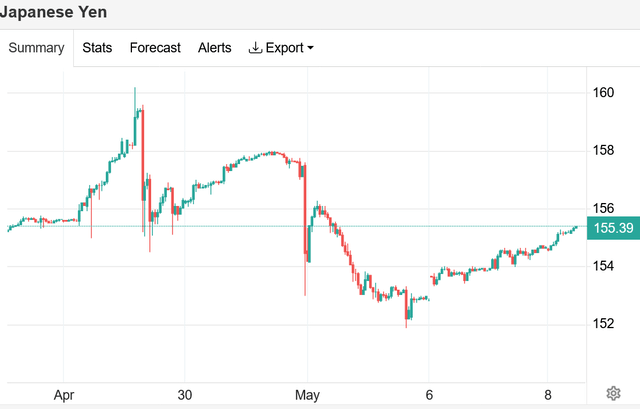

Her genius idea is to allow Fannie and Freddie to buy government-guaranteed second mortgages so idiots can spend a lot more money on crap. Oh, and BOJ blew through a third of its cash buying yen.

Bank of Japan only has $155 in dollar cash with which to support the yen. That means they can do what they just did, only 2 more times.

After that, they're going to have to sell treasurys to raise more dollar cash to support the yen.

Meredith Whitney advocates for Freddie Mac to buy second mortgages, potentially injecting trillions into the US economy and ensuring another catastrophic housing crash.

We're back to the level from which the yen broke down, about 155.6 (or up on the chart below, up meaning down). It's definitely starting to look like the Bank of Japan is playing an unsuccessful game of Whack-A-Mole. They've spent about $60B buying yen so far according to the MSM, but I'm not sure if they're counting all smashes. It might be closer to $100B.

I found some more exact math out of Reuters as to what's going on:

Speculators also realize that the government's war chest isn't bottomless. Japan has about $1.3 trillion in currency reserves, but only around $155 billion that it holds in dollar deposits are liquid.

Keep reading with a 7-day free trial

Subscribe to The End Game Investor to keep reading this post and get 7 days of free access to the full post archives.