We're All On Drugs And The Only Way Off Is To Run Out Of Drugs

There is no voluntary weaning off the inflationary system for anyone in it, and that's everyone. It has to crash. That's the only way out.

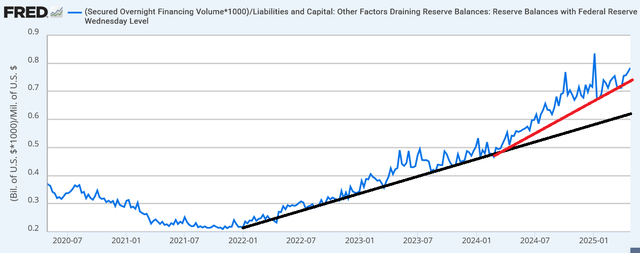

Repos to Reserves Skirt 82%

Repos hit $2.623 trillion yesterday. The latest bank reserves reading is $3.209 trillion as of last Wednesday. Divide repos by reserves and that puts the ratio at 81.73%. May could see us finally get past the 83% previous repocalypse level. We are close enough now that post debt ceiling raise should almost certainly see us push through that level.

Our plumbing correspondent at Bloomberg, Alex Harris, is reporting on repo funding strains at the end of the month again, which typically happen anyway, but they're apparently worse now, or so she says. She reports:

Volatility has increased in the past couple of trading sessions on the heels of a cash exodus from the government sponsored enterprises and as banks pivot to month-end, when they reign in activity to shore up their balance sheets. But the severity of the uptick is shaping up to look more like the acute turns seen at quarter- and year-end periods.

At one point, the rate on overnight general collateral repurchase agreements for April 30 traded as high as 4.52%, though is now 4.47%/4.46%, according to Tradition Securities. Demand has also swelled for sponsored repo, a key source of liquidity for the money-market fund industry.

The pace is excruciating given how close we are to the previous crisis ratio but the trend line since early 2024 is still intact and we will get past the 83% mark at some point, במהרה בימינו אמן. The rate of increase in this ratio picked up around early 2024 (see below) and there is no reason it should stop rising until it triggers the final crisis.

It won't stop rising because the basis trade that this ratio represents is lucrative for banks and once they see they can keep pocketing cash by ramping the thing up 50x a day, they won't voluntarily stop. They can't, really, just like nobody suffering from inflation can afford not to raise prices. The system is in control at this point, really has been from the beginning, it's just difficult to see it that way. Evil has its own way of self-perpetuating until it consumes all resources, like communism, and there's not much a collective can do to fight it if they're not willing to deal with the consequences of ending it, which are extreme, and which the collective certainly does not want to deal with, let alone most individuals.

In other words, we're all on drugs and all the rehab centers are on drugs and there's no way out other than running out of drugs.

The larger point here is that no country can simply choose to exit the dollar system because they have a better one. Everyone is at the mercy of the inflationary system as it currently exists. When it crashes, everyone will be able to reset, and the base will be gold, and hopefully silver as well.

Record Silver Deliveries in One Day Yesterday

Keep reading with a 7-day free trial

Subscribe to The End Game Investor to keep reading this post and get 7 days of free access to the full post archives.