Weekend Report: Gold To Commodities Breakthrough Imminent

The public should not be involved in investing. That's for capitalists and entrepreneurs. When the entire public "invests", dollars get everywhere, like Anakin Skywalker talking about sand.

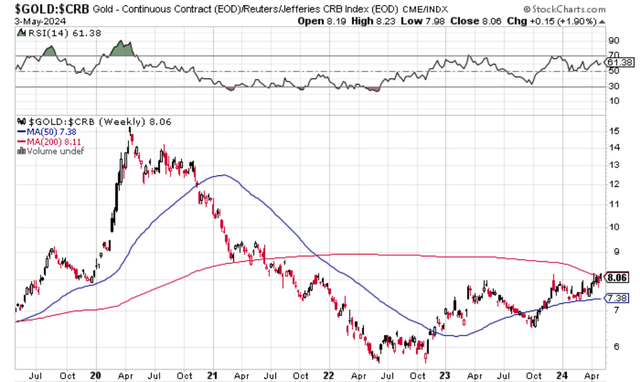

Gold is up 1% this morning in dollars and on the verge of breaking through the 200WMA relative to other commodities, a very rare event.

The focus should be on gold's behavior relative to other commodities, which is what makes it the best money, not its value in dollars (though obviously this is also important).

CMBS office delinquencies break 10%, how much longer can banks hang on?

Basis trade on Treasurys reaches new insane heights.

Gold to Commodities Breakthrough This Week?

Gold is up 1% in dollars to start the week, and we're also on the cusp of breaking through the 200WMA relative to other commodities. This is a very rare event that has only happened 3 times since 2008.

It's a big mistake to confuse a gold bull market with a commodity bull market. People are way too hyperfocused on gold in dollar terms, but it's gold's behavior relative to other commodities that makes it a good money. Money must be a commodity, and the most liquid commodity is the best money. One of the things that makes gold the most liquid commodity is that it always rises against other commodities over the long term, which assures people that all they have to do is hold it (meaning save) and they will become richer in gold terms. The best money rises over time relative to other commodities.

Obviously we're not talking about saving in normal times here. We're talking about a radical revaluation as derivatives collapse and it forces most liquidity back into money itself in a rush, for lack of anywhere else to reliably store it.

In a normal, noninflationary sound money economy, investment is only for entrepreneurs and capitalists who take risks for a living. The phenomenon of the public being involved in investment at all is itself an unhealthy phenomenon reflective of the fact that the public has no choice since saving isn't worth it because interest rates are artificially low and the currency is being inflated and losing value.

The public should save, and capitalists should invest some of the money the public saves. If the entire public is involved in investing because saving doesn’t work because the government is killing the currency on purpose, things get crazy, as we all know. Let alone the public being led into mutli-layered insane derivative securities options and crytpocurrencies that don't even exist. We've seen what happens when the public invests in anything in a horde.

Keep reading with a 7-day free trial

Subscribe to The End Game Investor to keep reading this post and get 7 days of free access to the full post archives.