Weekend Report: Bullion Banks Second Most Short Gold Ever, Moment Of Truth?

It's looking like March 2022, February 2020, and July 2016 on the gold COTs. But this time bullion banks may be in big trouble. Be careful either way, and don't try to predict the short term.

Bullion banks are extremely short in the futures market, indicating potential major top in gold, or a squeeze, impossible to tell which.

The February 2020 top in gold predicted by bullion bank shorts was short term, but it was still extreme.

China's moves away from the USD are only laying the groundwork for the escape from the dollar, but are not an escape in their own right.

BRICS countries' blockchain system may bypass SWIFT but still depend on the US dollar for pricing.

The Moment of Truth for COTs?

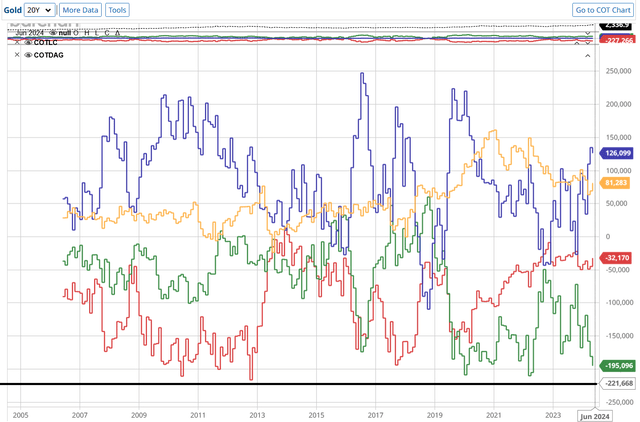

I usually don't pay much attention to the COTs, which show the positioning in futures of various trading groups. I don't completely trust them so I don't report on them often. But when things get really extreme I say something. They're really extreme right now.

Swaps, AKA bullion banks (the ones who supposedly sell futures in New York and buy spot in London) are the second most short they've ever been. I drew a black line at the current position of -221K, which for some buggy reason doesn't show up on a max chart. This level has corresponded with major tops in the past. See below.

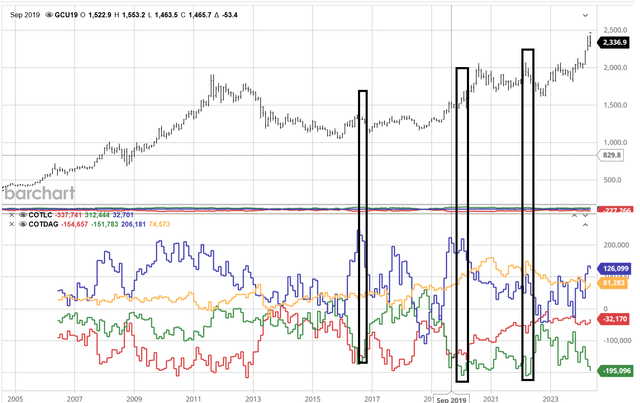

I had to get my kids to help me with this one because the red and green lines like exactly the same to me and I kept getting confused. But this is what we worked out. The last three times (black rectangles) the green hit even near levels we're at now, we had major tops in gold. Those were March/April 2022 around the nickel crisis, February 2020 just before the lockdowns (as if they banks knew, and they probably did) and the July 2016 top. February 2020 was only a short term top but it was still brutal to hold through nonetheless.

Well, the bullion banks are the second most short ever now so they either know something or they're in big trouble (if they're not in fact hedged in London).

We'll find out soon enough. I would not pile in here on a trade, but of course I would not sell either. One of these days the bullion banks are going to get stuck.

Blockchain Payments for BRICS Would not Fully Escape the US Dollar

Keep reading with a 7-day free trial

Subscribe to The End Game Investor to keep reading this post and get 7 days of free access to the full post archives.