Weekend Report: 5Y Note Futures Circus, Gold Bullion Bank Short Record, QT Continues Apace

Short contracts in 5Y Note futures WAY beyond all time records fueled by 76¢ spread between futures & spot, irresistible free money for leveraged funds using $272B in repo to magnify the trade. Uhoh.

Summary

An anomaly in the 5 Year Note is causing a significant spread between futures and spot, attracting leveraged funds to play the basis tried to the tune of $272 billion.

The repo market volume continues to increase, breaking $2T a night consistently now, possibly due to the 5Y Note basis trade that uses repo funds to leverage it at scale.

The Federal Reserve has not slowed down quantitative tightening (QT) yet, selling nearly $30B in notes and bonds in June.

Near record bullion bank shorts portend a worrying situation in the metals in the short term. Be careful now, I'm holding on to excess cash.

It's the 5Y Note People!

The move in silver is big, but I believe it's a distraction. Give it a rest, let the market work iself out here, and look at this: The elephant in the room is now the 5 Year Note. I haven't seen anyone talk about this at all. Not a peep from any side. As far as I know I'm the only one who notices this. There is an enormous basis trade happening in the 5Y Note right now. The spread between futures and spot for this paper is currently a whopping 76 cents. That's enormous. Compare that to the 10Y note which is only 8.5 cents, 3Y Note at 5 cents, 2Y Note at 8 cents, and 30Y Bond at 4 cents. For some reason there is an anomaly at the 5Y Note that is making the spread about 10x what it should be, and leveraged funds are descending on it like vultures and feasting.

Why nobody has noticed I can't say. And why the spread is so big I haven't figured out yet.

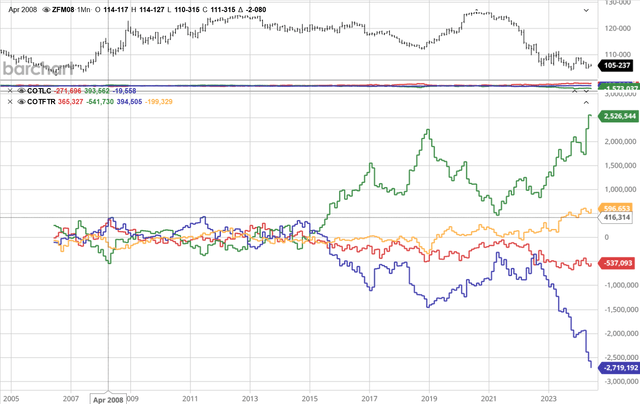

Anyway, it's free money for anyone with the capital to sell futures and buy spot to cover, at scale. As a result the amount of short positions in 5Y notes is at a new all time record high of 2.7 million contracts the equivalent of $272B worth of 5Y notes. This is wild. Look at the blue line, which is leveraged funds.

Whoever is doing this is going into the repo market to borrow hundreds of billions and magnify the trade like crazy. That's probably why repo market volumes are $2 trillion a night now. When the dollars in the repo market finally run out (QT continues, shrinking the dollar supply, and the repo market keeps getting busier anyway), there's probably going to be an explosion in 5Y notes specifically.

Repo Market Now Consistently Above $2T Per Night

Keep reading with a 7-day free trial

Subscribe to The End Game Investor to keep reading this post and get 7 days of free access to the full post archives.