Two Years Of Fed Losses, And The 8 Stages Of Monetary Grief

Denial, crashing, printing, tapering, tightening, depression, printing, End Game acceptance.

Federal Reserve has accumulated $191.3B in losses over two years, at a rate of about $100B a year.

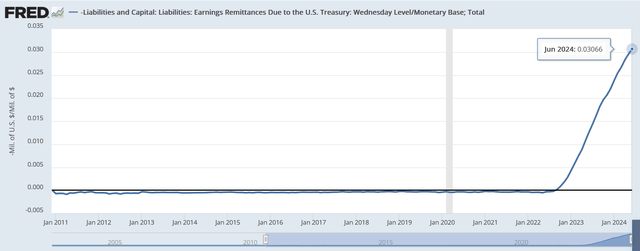

Percentage of dollars backed by deferred assets has passed 3%, interesting to know at what percentage were other hyperinflations triggered.

Dividing the RRP/Reserves interplay into 8 stages of monetary grief.

Coming Up on Two Years of Federal Reserve Losses

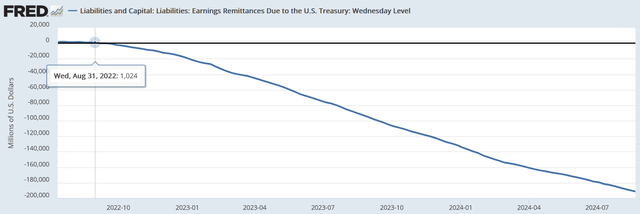

August 31, 2022 was the last time the Fed had any retained earnings. Next week will be two years, and we are at $191.3B in losses. That's a rate of about $100B a year.

However, this is not the rate that should be focused on. What's more important I think is that percentage of fed balance sheet dollars (AKA the "monetary base") that are "backed" by deferred assets, meaning backed by literally nothing, not even bad debt that can't be paid that is at least nominally an asset, theoretically. A deferred asset isn't even nominally an asset. Hence it is "deferred".

As the rate of QT slows down, the rate at which the Fed accumulates losses or "deferred assets" will slow. But the percentage of dollars backed by these deferred assets will not slow. If the rate of loss accumulation matches the rate of balance sheet shrinkage, the ratio will stay the same. Just this week, the ratio passed 3%.

It would be a fascinating research project to figure out, from past hyperinflation, at what percentage of deferred assets to monetary base does hyperinflation tend to kick in, in other countries. If we can find information on that, it would really help triangulation the End Game further. Here's that ratio kajiggered from Fred.

Deferred assets can be seen as the backend rot that causes hyperinflation in the mechanical sense. They are the realization that the debt backing the currency is worthless, as the central bank would be buying the debt high and selling it low, booking losses, proving in that way that the debt actually is worthless.

The RRP/Reserves Chart, Monetary Grief Divided into 8 Stages

Keep reading with a 7-day free trial

Subscribe to The End Game Investor to keep reading this post and get 7 days of free access to the full post archives.