Treasury Cash Falls To $260B, Unemployment Spike, ETF Demand, And War Update

Pakistan getting involved? That's not good.

I’ll begin by reiterating that I am completely against the US getting involved in this war, for Israel’s sake. If they do, it will only make anti Jewish hatred even worse than it already is. This is our fight, and we must do this alone. Hopefully Trump refuses Bibi’s pleading for him to get directly involved. If you’re in the US, call your representatives and remind them you are against getting involved in foreign wars.

Treasury Account Down to $260B, Corporate Tax Day Today

Expect to see the Treasury's account to jump up to around $360B or so by the end of the week. They've burned through $400B in 6 weeks, so that gives us another 6 weeks or so until crunch time.

Checking in on the Unemployment Rate

Unemployment is stuck at 4.2%. That's been the ceiling for about a year now, since last July. The next report is out July 3. I understand this rate is manipulated, but it's still a good proxy.

You can see how well it predicts "recessions" long term.

You can see on the long term chart going back to the 1940s that we are in the longest trend higher in unemployment without triggering a recession, ever. That makes sense in a twisted way since we are following the biggest money printing operation ever. Unemployment bottomed at 3.4% in April 2023. That's the lowest unemployment rate since the late 1960s. But it will break higher, of that I'm certain, as it always does.

More on unemployment, continuing claims have climbed consistently since June 2022.

Gold Price Increase Expectations

The Fed has a nice little chart comparing expectations for price increases in one year for gold versus gas, food, medical care, college education, and rent. Some of this data is very noisy, since medical care and college education costs are so artificial and scammy, my take on this is that once expectations for gold prices accelerate faster than expectation for food prices, we're on the road to hyperinflation. In hyperinflation, the price of money accelerates faster than anything else, even food, because as credit dies, the shortage is in money primarily, which causes the shortages in everything else for lack of any way to distribute resources. Therefore, when gold prices are expected to accelerate faster than food consistently, that's it.

Gold price increase expectations have moved up consistently to the 4-6% range, and have been drastically below the actual annual increases for two years. All it will take is for people to actually realize this and the public will start chasing. They still have no idea.

My wife was visiting an elderly couple in our community today and she watched a movie about the gold rush with them, just coincidentally. The husband commented that he didn't understand why people chased gold. She answered that civilization is based on trade, which is based on gold because it's liquid. He countered that he thought gold was about $1,900. He was shocked when she told him it was $3,500. The problem is that consciousness of the gold price tends to spring upon the public suddenly, which is what hyperinflation is.

(Just ran to bomb shelter next door, siren, all missiles shot down. I'm out now. Anyway…)

Platinum Premiums

Physical platinum premiums were at record highs until the recent rally, of between 18-19%. This suggests that the current rally is very justified. It's just the spot price catching up to the physical price. Premiums have gotten as low as 4% in 2008. We are at 14.4%, towards the very high end of the spectrum.

By the same token, palladium should follow platinum.

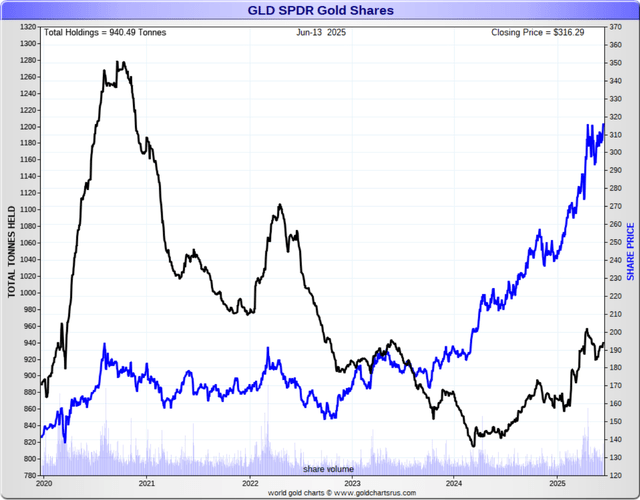

ETF Demand Still Muted

If gold and silver ETF demand pick up substantially (and they will when stocks start noticeably crashing), it's going to be a bidding war between Comex, London, and the ETFs. There isn't enough bullion to satisfy 2020 level of demand for gold ETFs with this level of demand in both New York and London. You can see below that the demand for GLD has increase slightly, but nowhere near as much as it did in 2020 and we're still substantially below the peak in GLD holdings.

If ETF demand wakes up, it could trigger a spiral higher in gold prices (and silver). Normally you would say that the cure to high prices is high prices, since higher prices dampen demand. But that doesn't apply to gold or silver, since higher prices stimulate more demand. The only thing that breaks it is the demand for dollars to service debt, but printing and/or defaults solves that problem equally well. I still think the next round of inflation will be the last.

War Update

At the risk of sounding Armageddonish (I'm not worried about the world ending, I'm pretty optimistic), the war situation is certainly lining up with timing here, in the sense that the next round of inflation by the Fed should destroy the dollar and that final round should follow close after the final raising of the debt ceiling.

I'm hearing from sources that senior leadership in Iran is considering fleeing the country for shelter in Russia if the situation in Tehran worsens (that would mean regime change), and that Tehran is passing messages to Israel through Cyprus behind the scenes as they're getting desperate. Outwardly they're threatening us with bigger "more technological" bombs tonight, whatever that means. The biggest hit they scored so far was an apartment building in Bat Yam, south of Tel Aviv. Nothing doing where I am, for now, and Hezbollah is dead in the water still.

The only worrying piece of news I heard is that Pakistan is threatening to supply Iran with bigger missiles. If they get involved, it could get bad. The IAF is bombing military and power infrastructure targets relentlessly now with zero opposition, having taken out all air defenses within the first few minutes on Friday.

🙏 stay safe

Prayers, stay safe