There Comes a Time in Every Central Bank’s Life...

When The Public Stops Believing Their Bullshit Inflation Control Narrative

Core PCE price index expected to rise 0.4%, which has only been hit 5x in the pre Covid era since 1993.

Gold and palladium open interest and deliveries update - deliveries in both metals due Wednesday night, palladium could be squeezed at any time.

Europe heading into Keynesian recession, with 11 European countries officially in recession and inflation rising.

Bank reserves are coming almost exclusively from the reverse repo facility dollar tank at an ROI of $7.37 to $1 in reserves.

This is from Bloomberg, and though it sounds relatively innocuous, it could be a turning point:

The core personal consumption expenditures [PCE] price index, which excludes food and energy costs, is seen rising 0.4% from a month earlier. That would mark the second straight monthly acceleration in a gauge that’s largely been receding over the past two years.

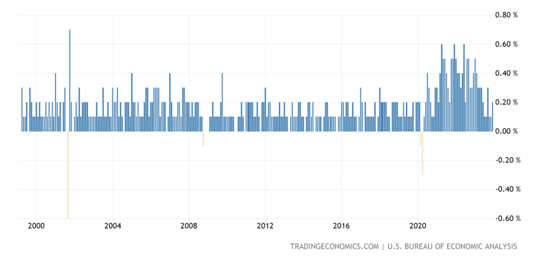

The core PCE is the most manipulated, dishonest of price inflation gauges. It's also the one that the Fed "loves the most". 0.4% doesn't sound like a lot, but look below. The 0.4% mark is on the horizontal. It has only been hit 5 times in the pre Covid era since 1993.

If we it 0.5% on Thursday, say goodbye to any possibility of a rate cut until the next financial crisis forces it. 0.5% has only been hit 3x since 1989 in the pre Covid era. If core PCE hits 0.5% on Thursday, there will be virtually no doubt that we are in the second wave, and the Fed will not be able to control this one. Rate hikes won't do it. The historic ~24M lull in a double price inflationary wave should be over.

Open Interest and Deliveries, Gold and Palladium

Keep reading with a 7-day free trial

Subscribe to The End Game Investor to keep reading this post and get 7 days of free access to the full post archives.