The Rarest Of Bullish Gold Signals About To Be Triggered Within Days

The last time it was triggered was 2001. The time before that, the early 1970s. It's about to be triggered again. And it doesn't even have to do with orangutans.

Daniel Oliver's new paper explains why gold falls during credit spurts and rises during busts, the opposite of what Keynesians want you to believe.

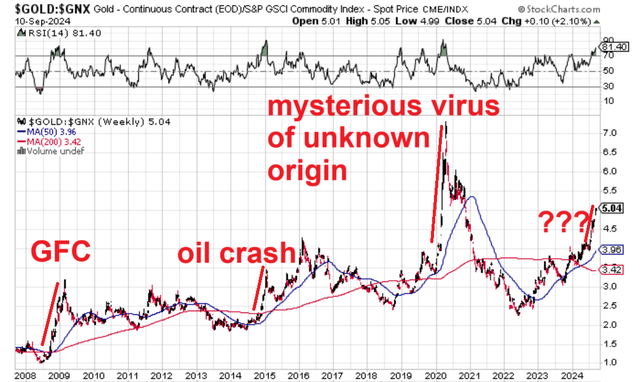

The gold to commodities (GNX) ratio is rising at a crisis-level pace, and silver's open interest has reset, indicating potential for another rally before a final liquidity crunch.

An extremely rare bullish gold signal is imminent, suggesting gold's significant outperformance over stocks, a signal last seen in 2001.

Myrmikan Breaks Silence Again

Daniel Oliver is out with a new piece yesterday, a pleasant surprise. The most interesting paragraphs and my commentary (my bold):

Investors should be mindful, however, that the past supports the Austrian economic thesis that in order to maintain artificially high rates of capital growth, the central bank must print at an ever-increasing rate. In other words, an effective stimulus will require credit creation greater than 2008, greater even than COVID. And that will be hard to justify without a large accident in the capital markets.

This is essentially the EGI thesis. One more "large accident in the capital markets" that will justify a stimulus even greater than COVID. There is no other possibility. All it requires is to recognize this and be more patient than purgatory.

Gold is unique in that it is the one capital asset that is priced like a good: to explain, capital is valuable because it earns income over time, making its price highly dependent upon discount rates. Industrial commodities are demanded principally to construct (and maintain) capital assets, making commodity prices highly levered to the value of capital assets (and, therefore, even more so to discount rates).

Gold, by contrast, is valued as money, as value in the present. This is why gold underperforms during a credit bubble—when discount rates are falling and capital assets and commodities are surging—and outperforms in the bust. This is the reason why despite growing uneasiness in the capital markets, gold sits stubbornly just at all time highs, up 96% since 2019. Gold senses what is coming: further debasement by the next administration, whichever it is, and money printing by the Fed at a shocking pace.

My addition: The fact that gold has kept reaching new highs despite the record credit surge since 2020, means to me that the next bust is going to see the sudden market move to forcibly balance the Fed's balance sheet, just like 1979-1980.

Unilke in 1980, which saw no sovereign debt crisis, this time a global sovereign debt crisis will coincide with the forced rebalancing of the Fed's balance sheet, along with every other central bank on the face of the Earth.

Gold to Commodities Ratio Rising at Financial Crisis Pace

The gold to GNX (commodities weighted by production) ratio is rising at a pace consistent with previous financial crises. I drew sloped red lines during the last 3, and matched it with this one, whatever this one is. The 2008 GFC, the 2014 oil crash, the 2020 whatever, and this year. Something's afoot. Hang on.

Silver Open Interest Resets Down

Keep reading with a 7-day free trial

Subscribe to The End Game Investor to keep reading this post and get 7 days of free access to the full post archives.