The Only Difference Between Repocalypse Of 2019 And Now Is Stimulant Budget For Fed Staff. Probably.

And everyone is using the term "End Game" these days. I was saying it before it was cool. (I was also early.)

The Fed's standing repo facility may not prevent another "Repocalypse," as it failed to control rates during the 2019 crisis despite rapid intervention.

Gold's relationship with interest rates is misunderstood; historically, gold rises with rates. The last 43 years have been an aberration from the previous several thousand.

The term "End Game" is gaining traction, Alasdair MacLeod and Danial Oliver both use the term in recent statements.

Nearly $1 trillion in commercial mortgages are due this year. Sounds jolly good.

The Standing Repo Facility May Not Stop a Repocalypse

The difference between the Repocalypse of 2019 and now is that now there is a "standing repo facility" that is supposedly on hand from the Fred to keep repo rates under control even if there's a crunch. The Fed has some kind of crack team of repo men armed with truckloads of dollars ready to fling them at banks who need repo at a moment's notice. Rumor has it they're hyped on barbiturates and desperate to push the repo button whenever the alarm goes off. They haven't slept in months.

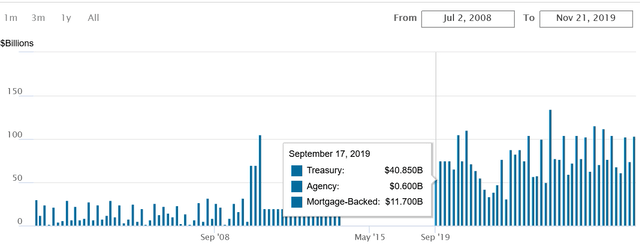

But see below, and you'll notice that the day of the repocalypse last time, the Fed had already opened the spigots that same day, so practically it was a "standing repo facility" back then even though it wasn't officially. Instead of a crack team of repo men high on stimulants, ready to push the button, the team was woken up and within 5 minutes they were pushing buttons already. What's the practical difference? Besides lots more budget allocated to drugs for Fed staff this time, I'm really not quite sure.

There was nothing in Fed-sponsored repo for about 10 years (the previous significant repo operation from the Fed was in 2009) before September 17, 2019, and then all the sudden $40B on the day of the repocalypse. It didn't work then to suppress rates before the spiked, and I doubt it'll work now to keep rates from spiking.

The Term "End Game" is Getting a Lot More Popular These Days

First Bloomberg, now my top two gold analysts, Daniel Oliver and Alasdair MacLeod. We'll start with Oliver, who describes the End Game twice in this panel. I highly recommend you listen to it, at least to his parts.

Daniel Oliver

This panel is two months old but it's new to me so I'm sharing it. Oliver is on a panel on whether gold is in a pullback or a rally. The first point he makes is one I've made here, namely that gold moves up with interest rates, not down, and that this hasn't held since 1980 is the aberration, not the rule. The rule has yet to reestablish itself, and we are still in the aberration, even though when you iron it all out, gold has been rising with interest rates anyway. The wiggles within the overall pattern still suggest that gold moves inversely with interest rates, not together, as was the case in the 70s and most of world history.

You can see below how gold trends higher with interest rates even though it seems to have an in inverse pattern established. The reason is that gold only stalls as rates rise, and then catches up fast as rates stabilize at the higher level. (Gold is the thinner line below.)

Then Oliver makes the fascinating point that I hadn't thought about, and that is that in the Roman era, Rome would export silver to China in exchange for silk and spices into the empire – consumables – so China would get the money and Rome the trinkets. China had functioning copper mines but no gold or silver.

This is the same thing that's happening now – the West (modern Rome) is exporting gold to China via the dollar, which China uses to buy gold, and the West ends up with consumables, nowadays trinkets instead of silk and spices. Rome fell, and so will the West. Oliver's overarching point is that gold (and ultimately silver) moves from consumers to savers, until the consumers run out of money, and then the balance of power shifts.

The next point he makes regarding gold and silver equities is that retail sets the institutional price, which is at a discount to retail. Meaning, if a miner is going to get institutional money, it is going to sell shares at a discount to the retail price, and retailers aren't in the market because they have variable rate mortgages to pay. For now, gold and silver miners are making enough cash flow by themselves to expand without external investment. It's just slower and less exciting. But the market will turn and these companies will be discovered eventually.

At the 26:20, Oliver gives his view of where the gold price will peak, and he gives it as usual in terms of the percentage of gold-backing on the Fed's balance sheet. And yes, he uses the term "End Game" and predicts that it will happen suddenly, but can't say when.

The last point he makes is that to support a currency, a central banks sells the assets on its balance sheet in order to buy its liability units, which is the currency. He mentions the Bank of Israel, which sold dollar assets and bought shekels after the October 7 attack to arrest the fall of the shekel. He mentions Japan, which sold dollar assets and bought the Yen to stop its collapse at 160. (In my view this only worked temporarily by scaring the shorts out of the carry trade.) But the Fed can't sell anything. Their assets are impaired. Nobody wants 30Y treasurys at a 2.5% fixed rate coupon. The price will have to collapse in order for anyone to buy this crap, and so the Fed cannot sell anything to support the dollar.

That, he says, is the End Game. במהרה בימינו אמן.

Alasdair MacLeod

Keep reading with a 7-day free trial

Subscribe to The End Game Investor to keep reading this post and get 7 days of free access to the full post archives.