The End Is Nigher Than Last Week, And Basis Trades Gone WILD

Gold looks exciting but shaky at these levels so I'm staying away from leverage. But I still own some way OTM call options from last year that are almost in the money now. Whooda thunk?

Now even Art Laffer calls the End Game, GLD holdings show minimal signs of life, Open interest in gold futures return to dangerous levels.

Stay away from leverage unless it's OTM call options. Specific ones mentioned below for paid subscribers.

Basis trades in Treasury Notes continue to explode higher at a dizzying pace as they suck up more repo dollars by the week.

Zoom Out and It's Obvious We are Very Close

A picture is certainly worth however many words this post will end up being.

Gold is up. Strange.

Art Laffer Calls the End Game

Art Laffer, who doesn't know much about economics but he's still famous for some curve or other about taxes or something, sees the End Game ahead. From Kitco:

"We're in a new period of collapse of the U.S. dollar, and it's quite frightening. What will take its place is still up for grabs," he said. "People are moving into all sorts of alternatives to the U.S. dollar … Maybe Bitcoin, maybe gold, maybe some other set of currencies, but that is the direction we're headed."

The U.S. dollar is moving away from monetary stability and towards "an unhinged paper currency," according to Dr. Arthur Laffer, founder and chairman of Laffer Associates and former economic advisor to President Reagan and President Trump, who says time is running out to reverse this trend.

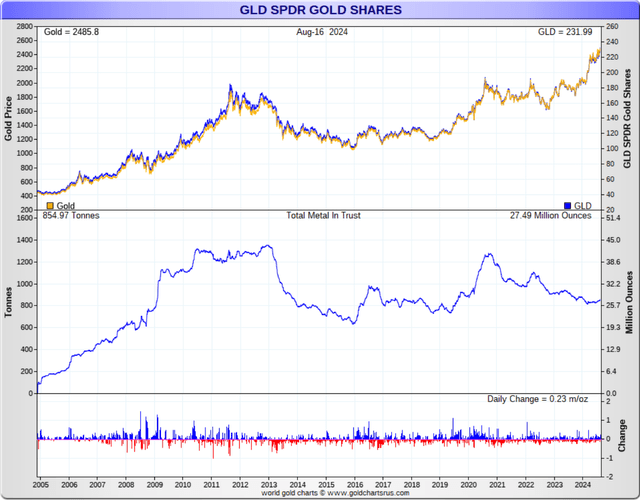

GLD Showing (Minimal) Signs of Life

GLD holdings have been lazily drifing higher since March. It looks a little bit impressive on a 6 month chart…

But when you zoom out you can see it's not so much. In fact you can barely see it.

And so my conclusion from this is that the paper retail traders and the money managers that move into these ETFs when they recognize trends, have still not woken up here. The price action in gold is being dictated by futures markets mostly, and those are dominated by banks selling contracts to hedge funds. Banks are still in record short territory in gold futures, making the current environment prone to crazy swings in the short term.

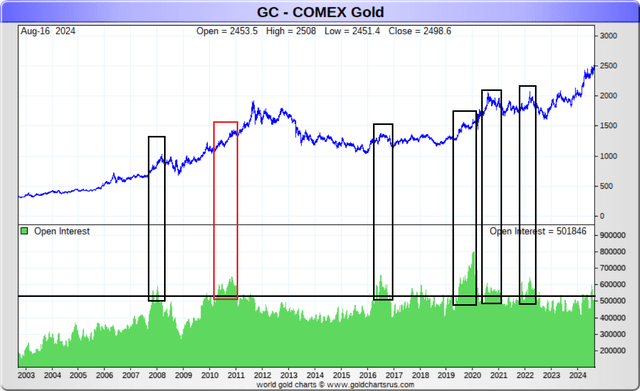

Open Interest Bursts Higher, Danger Zone Reentry

I'm staying cautious here and out of leveraged funds. Here's why, historically:

The black horizontal line is where open interest is now. As you can see by the rectangles, of the 6 times we were above that line as we are now, 5 were either major or minor tops. The exception was 2010 when went into a small short squeeze (falling open interest and rising gold price) that lasted about half a year into the 2011 top. That could happen this time, which is why I own the call options, but chances are we're not there yet, until we finish the final printing round that will come post final crisis. So I am staying cautious and not chasing here, playing the odds.

However, if you want to place a small bet on a short squeeze here, personally I do own

Keep reading with a 7-day free trial

Subscribe to The End Game Investor to keep reading this post and get 7 days of free access to the full post archives.