New SIFMA numbers show net Treasury Bill issuance since February continues negative, with outstanding T-Bills falling by $245.4B since March. Hence RRPs stagnate.

Still, they have not risen by $245B either, meaning money is still being sucked out of the banking system.

Spread between investment grade and junk bonds is near all-time lows despite persistently high interest rates, meaning something has its thumb on the scales. Keith Weiner believes he knows what.

The castration theory of global finance, OR how the Yen has its hands down the pants of the inverted pyramid, ready to squeeze and kill the dollar.

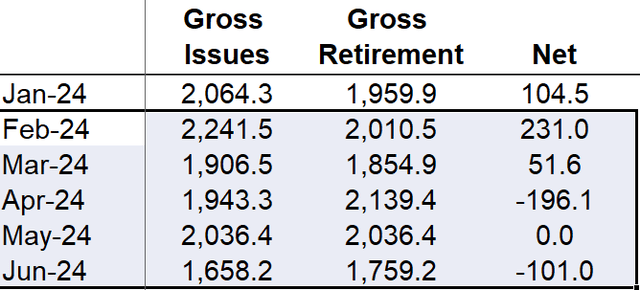

June SIFMA Numbers Show Net Bill Issuance Still Negative

The table above is Treasury Bill issuance since February. The net number -14.4, meaning, outstanding T-Bills have fallen by $14.4B since February. This is why reverse repos have stalled since February and have not fallen further on net. What is amazing is that not counting February, which was still hefty at $231B in net Bill issuance, the number is -$245.4. So basically since March, outstanding T-Bills have fallen by nearly a quarter of a trillion dollars.

Consider, on March 1, RRPs were $441.26B. The latest reading is $425.9. So, despite $245.4B less in T-Bills available, RRPs are still even to slightly down. That means about a quarter trillion were sucked out of RRPs even though numbers are basically even. If this were not the case, we would expect RRPs to be about a quarter trillion higher than they are now, given there are fewer alternatives available to storing cash in the RRP facility.

The RRPs will zero out whenever the Treasury is forced to raise short term cash.

The Castration Theory of Global Finance

On my latest video with Keith Weiner, he explained his theory as to why the next financial crisis hasn't happened yet.

Keep reading with a 7-day free trial

Subscribe to The End Game Investor to keep reading this post and get 7 days of free access to the full post archives.