The Banker War Begins

The mega rich duke it out in gold futures while ETFs and physical are ignored.

Gold open interest has increased significantly in a short period, indicating a clash between banks and wealthy individuals in futures trading.

Physical gold premiums are falling, and the public has not yet noticed the rally.

The FDIC is late in filing the quarterly banking profile, raising suspicions about the data they may not want to reveal.

Gold Open Interest Explodes Higher Still

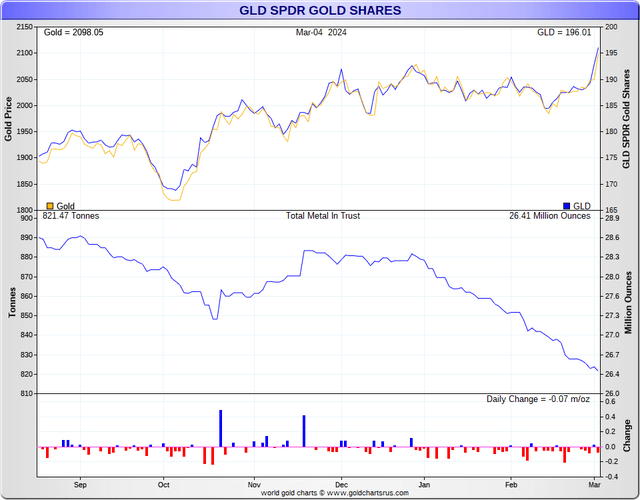

Open interest is gold is up 60,501 contracts in 3 days. That's about 15%, an enormous amount in 72 hours, and the ETFs have added basically nothing. Retail has been caught completely flatfooted on this. They are not buying GLD or any of the other funds. GLD was down another 70K ounces Monday and was flat Tuesday.

Total gold holdings across all transparent funds was down even more, 137K ounces Monday, another 166K ounces Tuesday. Meaning, the gold move we are now seeing is entirely a game of banks vs extremely rich people playing futures chicken. Why now, is the question. This is a clash of heavyweights. The public is not involved yet. In fact, the public is even less involved now than they were before this move started. They're distracted with Bitcoin crap.

I do not know the particulars of what is going on, but I know that both banks and the extremely rich have insider information about the monetary system, of which Bitcoin is not a part of, as much as crazy people want to convince us it is. It's a tulip side show. Those taking advantage of it use the libertarians as a means of pumping it and the big time pumpers stay in the background, but those making big money off this insanity are the standard statist socialist evil nothings. The liberty people who think they’re rich now will go down with the bankster ship on this cruise to monetary hell.

Keep reading with a 7-day free trial

Subscribe to The End Game Investor to keep reading this post and get 7 days of free access to the full post archives.