The 11-Year Gold Bear Market Vs Stocks Is Over

I'm calling it. (I'm calling it Steve, because that seems like a nonthreatening name for a very threatening bull market that's about to get scary for those who have no real money.)

$120B in Notes and Bonds up for auction, with $58B today, $39B tomorrow, and $22B on Thursday.

Yen coiling around 34-year support, expected to break soon but not likely to strengthen significantly.

SLV holdings rally with 26Moz flowing in over the past 3 weeks, reflecting a sustained rally in paper silver holdings.

Yup, we're still in 1978 looks like, for gold and silver.

Calling the End of the Gold Bear Market in Terms of Equities

Steve is coming.

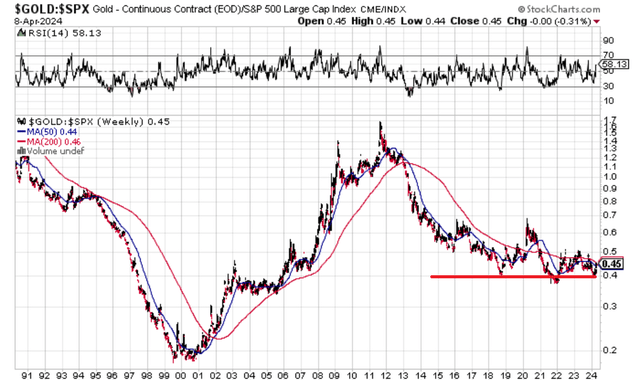

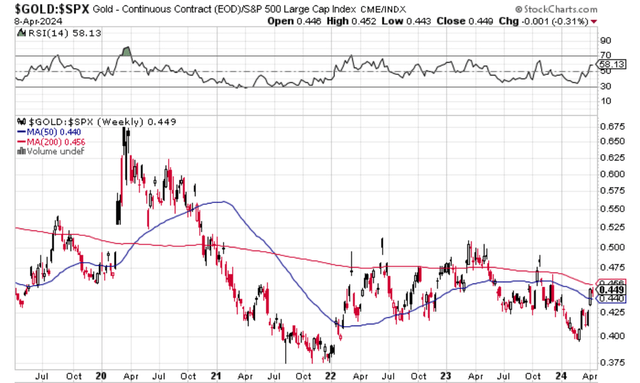

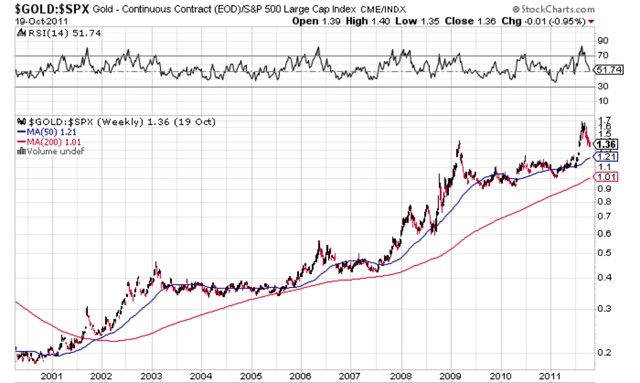

This is the gold to S&P 500 ratio. The lower it is, the worse gold is performing relative to stocks. We have a clear head and shoulders bottom in place from 2022. We just tested the second shoulder. We should be heading higher much faster now, after an 11 year bear market. Zooming in:

We just broke through the 50WMA and heading to the 200WMA. We should stay above that line for good now. During the 11-year bear market in terms of stocks from 2011 to 2022, we were consistently below, with what could be argued was an unnatural breakout due to lockdowns, and then some annoying tests since 2022.

From 2000 to 2011, we were consistently above that line, dancing on the 50WMA the whole time.

We should see something similar start to form now. A sustained break above the 200WMA will confirm it.

$120B in Notes and Bonds Up for Auction

Keep reading with a 7-day free trial

Subscribe to The End Game Investor to keep reading this post and get 7 days of free access to the full post archives.