Tariffs Cannot Resolve Trade Deficits, Daniel Oliver Proves It Historically

All they can do is hasten the demise of an inflationary system. Rebalancing trade means ending the inflationary policy that caused the imbalance in the first place.

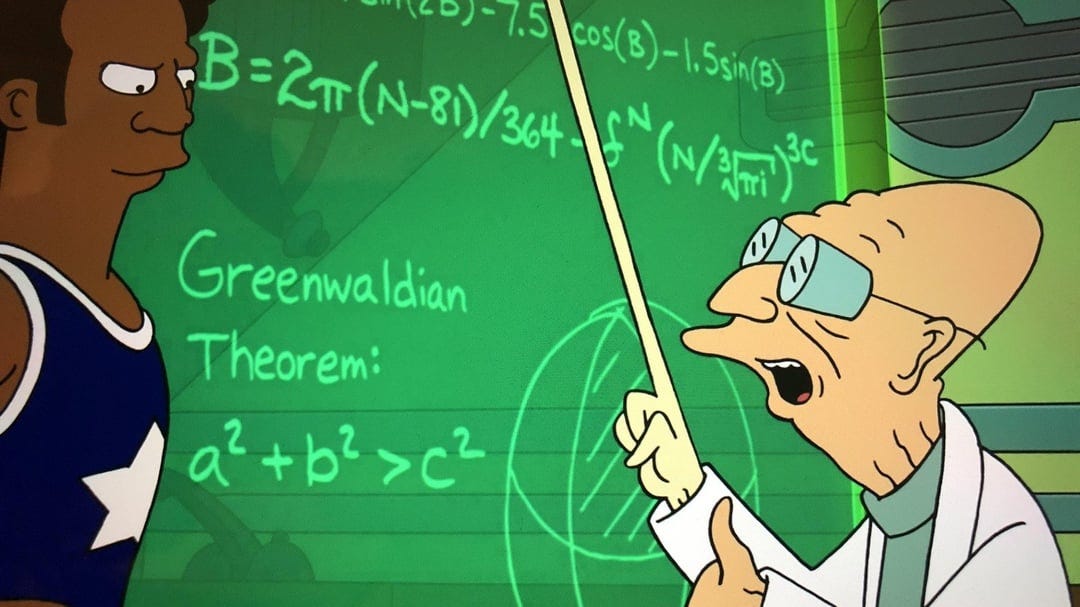

Gold Open Interest Back Down Near 450K with New All Time Highs

Gold's $250+ move the last 4 days came on a net move of less than 10K contracts in open interest. That means only 10K new longs were opened, about 2.2% of total positioning, and just that moved the price about 9%. What this suggests is that bottoms in gold are becoming more and more ephemeral. Dips will continue to happen but they will not last long. With OI now at just 454,450, there is now plenty of room for the price to move even higher with new contracts opening up, and I expect that is what will happen.

Silver will wake up when the public figures out their stock portfolios have stopped protecting them with imaginary purchasing power that does not actually exist.

ETF Market Just Starting to Wake Up

Retail buyers of gold and silver as an "inflation hedge" for their portfolios are still asleep, but they are just starting to wake up. Below is the GLD ETF, and you can see from market top August 2020 until about March 2024 (black rectangle) the price of GLD representing the price of gold (blue line) was basically even, just slightly higher. Retail lost interest in gold as an "inflation hedge" and GLD holdings collapsed about 480 tonnes, or close to 40%. Now that gold is moving in a sustained trajectory, the ETF investors are starting to notice and buying GLD to hedge their portfolios. GLD holdings (black line) are slowly heading back up.

GLD holders are mostly weak-handed holders and they'll panic out the minute gold falls in the next banking crisis.

Daniel Oliver Mines History to Prove Tariffs Do Not Resolve Trade Deficits

As usual, Daniel Oliver's latest piece is a must-read. Almost nobody (except maybe a few people at the Mises Institute) understands monetary history better than he does. Here are some of the key passages:

Keep reading with a 7-day free trial

Subscribe to The End Game Investor to keep reading this post and get 7 days of free access to the full post archives.