Special Report: Yen Breaking Down Above 160

The Bank of Japan had $136B in dollar cash in August 2023, and they've intervened twice to save the yen since then. The latest round cost $62B. They may be out of dollar cash already.

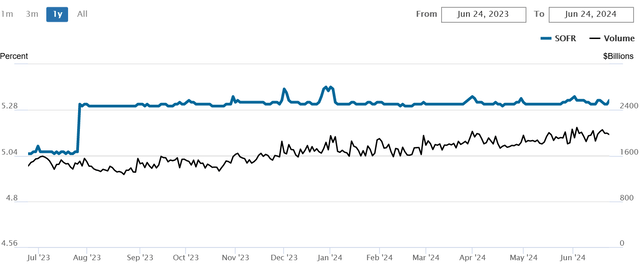

SOFR repo rate increased to 5.33% today from 5.31%, with repo volume nearly doubling from $1.2 trillion to $2 trillion in a year.

Money supply growth steady at 1.33%, Yen breaks 160 with potential BoJ intervention, if they have the ammo for it.

Commercial real estate firesale gaining steam as banks seek to offload discounted loans to family offices in private, avoiding the public exchanges so as not to freak out the market.

But Bloomberg is reporting on this, so i guess it's public now anyway.

SOFR Moves Up in Preparation for Quarter Turn, Money Growth Steady

The repo rate moved up 2 bases points to 5.33% yesterday. It's been between 5.30% and 5.4% since the last rate hike in July, 2023. Repo volume, however, has nearly doubled from $1.27 trillion to $2 trillion now. The next 4 business days into the quarter turn is going to be stressful for the repo market.

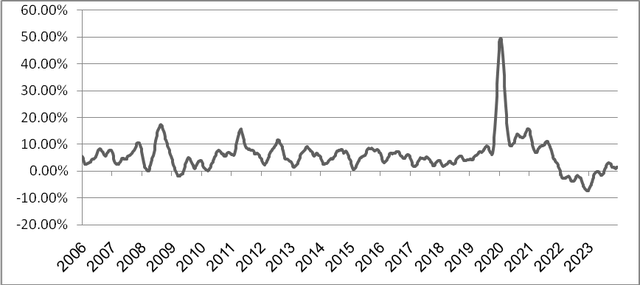

Money supply growth, meanwhile, is steady at a 1.33% quarterly annualized rate. It hasn't moved much in the past two months.

Yen Breaks 160

The Bank of Japan has only a few days to intervene here, otherwise the forex market has a chance of dumping the Yen. Right now forex traders are daring the BoJ to intervene, trading just around 160. With the sad situation of Norinchukin out of the bag, the BoJ will be very reluctant to sell Treasurys to support the exchange rate, as that would trash more Japanese banks. All they can really do is deplete their USD cash reserves.

According to these gobbledygook blah numbers from the Bank of Japan from August 2023, the BoJ had, at most, $136B in dollar cash at the time,

Keep reading with a 7-day free trial

Subscribe to The End Game Investor to keep reading this post and get 7 days of free access to the full post archives.