Silver's Final Resistance To $40, Platinum Awakens, 8 Weeks To Debt Ceiling Raise

And why physical silver deficits might actually matter kind of.

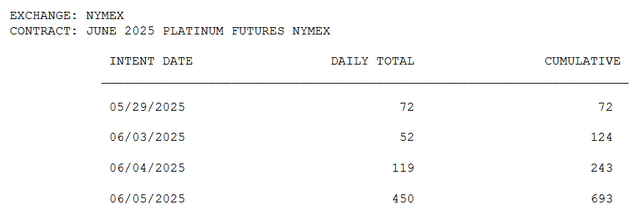

Platinum Awakens – Huge Deliveries, Record Volume, Near Record Open Interest

Lots of action in platinum yesterday. Most interesting was the number of spot buys for immediate delivery. Globex volume was 467 contracts. Net 331 new spot contracts were opened and we saw 450 deliveries on the same day. That's the most deliveries in a day this month, and its a number you'd normally see on the first day or two of deliveries of an active contract, not in the middle of an inactive one. June is not an active platinum contract and yet we just saw huge delivery numbers. Next month, July, is active, and 72K are still open.

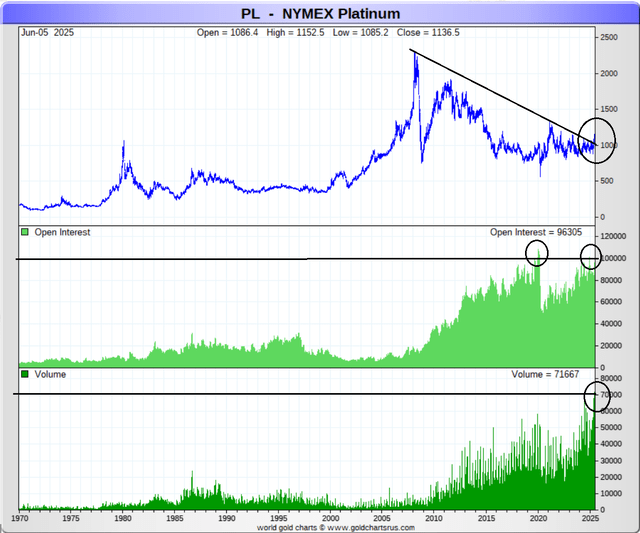

The triangle in platinum since 2008 does appear to be breaking out now. I drew two triangles here, one starting from 2008 and one from 2012. Regardless of which trend line you pick, platinum has broken both.

The platinum to silver ratio isn’t moving much though – still very low at around 31 – so what appears to be happening is silver pulling platinum higher, not platinum itself moving for its own reasons.

We also have near record open interest in platinum, and all time record trading volume of volume of 71,667 contracts yesterday.

The cauldron is heating up. Stay calm everyone.

Silver Breaks $36.40, Gold Open Interest Still DOA

We just broke $36.40 today. The last resistance until the $40s is from February 2012 at

Keep reading with a 7-day free trial

Subscribe to The End Game Investor to keep reading this post and get 7 days of free access to the full post archives.