Silver Threatens 13Y Bowl Resistance at $35, Breakout Imminent Possibly To $40 Range

It's gettin' shiny out there folks. The shininess is going to blind those who don't understand that silver is money. And gold is too. But you knew that.

Repo Volume Spikes, Repos to Reserves Ratio Climbs to 84.7%

We are back above the 83% previous repocalypse ratio as SOFR volume has spiked to $2.771 trillion on the first trading day of June. Tomorrow the SOFR volume should drop back down, but volume will of course continue to trend higher as the basis trade continues to expand. Once we get to the point where we are consistently above 83%, not just on days of the month-end repo spikes, then the final clog in the banking system should occur. We keep teasing it, but we will get there.

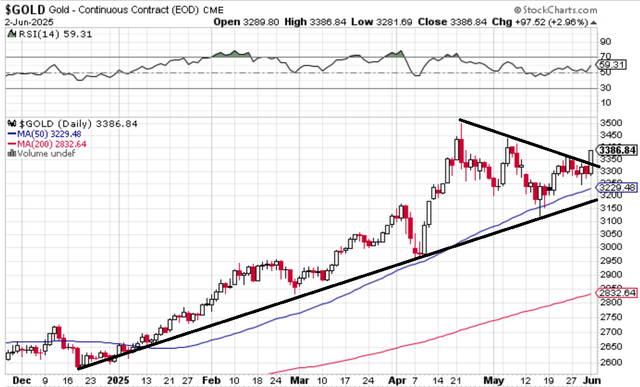

Gold Daily Triangle Broken to the Upside?

Weekly trend line still healthy and intact, both the shallower one from 2023 (black) and the steeper one from 2025 (red):

Gold open interest was up yesterday by over 10,000 contracts, but that's not a monster move. We're only at about 420K now, still very low.

Silver Challenges 13Y Resistance

Yesterday was a Jewish holiday (Shavuoth AKA Pentacost) so I didn't see what happened until late last night my time, and noticed that silver was up over 5%. As far as I can tell there were no obvious catalysts that would have caused this. People are talking about the Ukraine hit on Russian airfields but there is no compelling reason why this should push silver 5% higher rather than 5% lower. If silver crashed yesterday they'd say it was because of the bombing of Russia by Ukraine and a sapping of industrial demand or something. The reasons are generally made up after the fact.

I don't see how the move in silver was technical either, because we only pushed right up to long term resistance at $35, but did not push through it.

Open interest in silver did shoot up significantly though, about 8.1% or over 12K contracts to about 160K contracts, which is high for post 2020 but not super high. See red line below. Pre 2020 160,000 was actually a low.)

We are now at major resistance at $35. This resistance has been in place since just after the 2011 moon shot to $50. So yes, if

Keep reading with a 7-day free trial

Subscribe to The End Game Investor to keep reading this post and get 7 days of free access to the full post archives.