Silver Looks Like A Caged Animal

Reverse repos in the final plunge, it looks like, I hope, I pray.

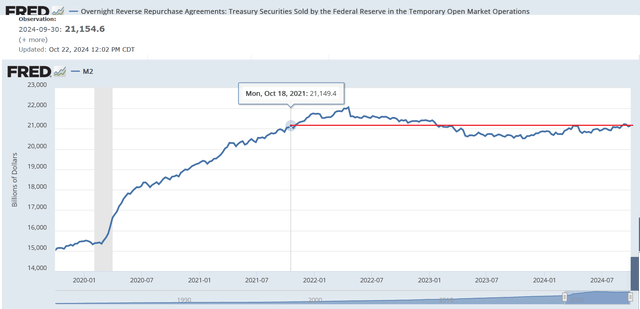

Money supply growth rate up to 3.33%, fastest since May 2022, but M2 still stagnant for 3 years.

Silver is moving strongly on every intraday gold rally, suggestion it really wants to break out to the $40s, and should very soon.

Reverse repos down to $200B, likely (hopefully) to zero out by November.

This gives us December for bank reserves to plummet into the year turn and trigger a repo crisis.

This will be followed by the final printing round, as election chaos threatens the country.

Gold to Silver Ratio Showing Signs of Breakdown

Silver is starting to surge on every minor intraday gold rally. It's happening again today. The ratio itself is still stuck in a range, but it's looking like silver is getting restless and wants to move faster than gold now. About damn time.

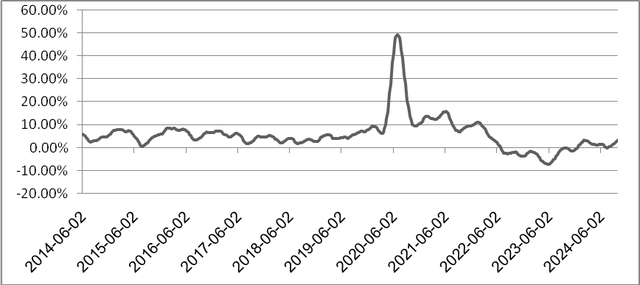

Money Supply Growth Rate Up to 3.3%

The M2 growth rate continues to rise. We are at 3.33% annual, the highest since May 2022.

Don't get too excited though. It doesn't mean asset prices are going to rally. If we take it in context, we see this:

M2 has not moved on net since October 18, 2021.

Plus, reverse repos are (hopefully) about to zero out in the next few weeks. I say this because

Keep reading with a 7-day free trial

Subscribe to The End Game Investor to keep reading this post and get 7 days of free access to the full post archives.