Gold to silver ratio plunge on Friday another hint I'm right about us being in 1979.

The plunge in the ratio continues this morning, with silver up 3.3% and gold up 0.6%.

Despite the excitement, this is not the time to get greedy or go all in. The final crunch is still ahead. Get excited when the Fed restarts QE, not now.

They will likely use either war or election chaos as an excuse to restart QE.

Platinum to silver ratio touches 30

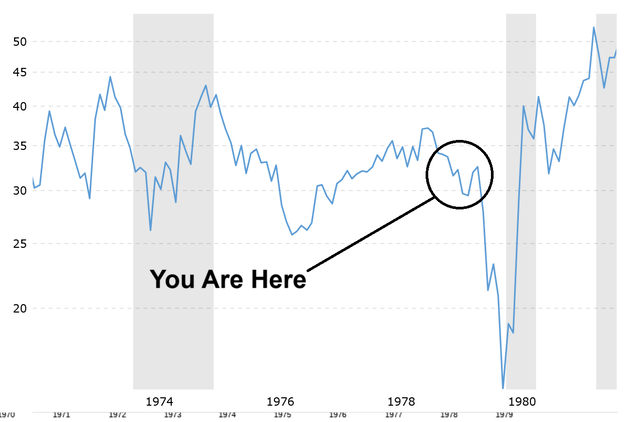

I said last week that if we are indeed in 1979, then the gold to silver ratio should start to fall. As of yesterday, that fall may have begun. We'll have to see if it follows through. So far this morning, it is. Silver is up another 3.3%, and gold 0.6%. I've circled where I think (hope?) we are in the gold to silver ratio using the 1970s parallel below.

Remember, gold usually makes new highs in advance of silver, and then silver catches up at the last minute and overshoots. That's what historically happens in a monetary panic. Here's where I think we are in gold, notice new highs by mid 1978:

And here's where we are in silver, notice no new highs until early 1979, about 8 months after gold:

Gold made new highs in March 2024. Silver is only making new highs now, about 7 months later, so we are tracking the 1970s pretty well. Nothing is exact, but it's fairly consistent. If I'm right, silver should start to go crazy in a matter of months, my guess is after the Fed is forced to restart QE, using war or election instability as an excuse, or both.

Maintain Caution Here and Don't Get Too Excited

Keep reading with a 7-day free trial

Subscribe to The End Game Investor to keep reading this post and get 7 days of free access to the full post archives.