Short Covering of Half a Million Ounces In GLD

And BOJ...Set...HIKE! Yen gets the ball and...he's running backwards! And he's down at the 150 yard line! It's a massacre!

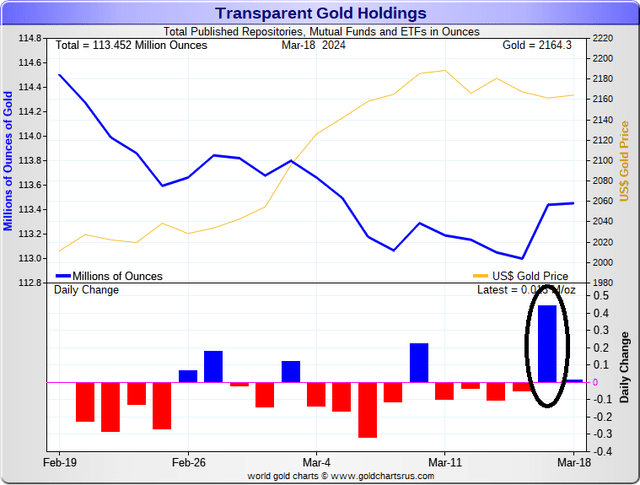

GLD holdings increased by 500Koz while paper funds only increased 420Koz suggesting specifically short covering in GLD by the authorized participating banks, at a loss.

The Bank of Japan's interest rate hike caused the Yen to fall, because the Yen is the JGB, so again, higher rates will lead to higher "inflation".

Mining companies are avoiding hedging in response to record-high gold prices, learning from past mistakes and positioning themselves for a gold spike.

Sorry for lack of weekend report this week. I was busy preparing my speech on money in Hebrew for the Agenda 2030 conference.

I will post the text as a free article on Substack today. I wrote it first in English then translated it so the original is actually in English.

Sorry about the lack of weekend report this weekend, I was preparing my speech for the 2030 agenda conference. I'll post the text on Substack and make it free access.

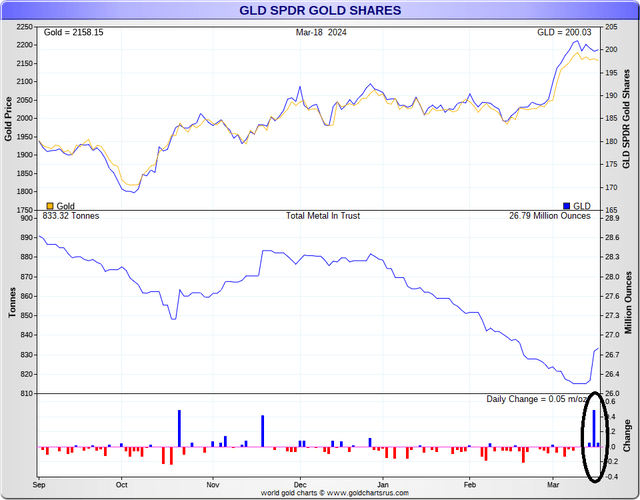

Weird Stuff Going on in GLD, Probably Short Covering

GLD holdings rocketed higher on Friday by about half a million ounces.

But here's the weird thing. Nothing happened in the IAU ETF, and nothing happened across any of the other gold funds across the world. They were up about 420K ounces across the board. See below.

If gold funds were up only 420K ounces but GLD was up 500K, then other funds were down 80K net. GLD was the only one that deposited gold. This to me looks like short covering in the GLD, which would necessitate gold being deposited. And if there was short covering, it was at a loss, and it was suffered by an authorized participant bank in GLD. What this tells me is that the rally has quite a while to go. The paper chasers are still asleep, just like the stackers. The banks are trying to fend off the high net worth family offices, looks to me.

Japan Hikes Rates, Yen Falls

Keep reading with a 7-day free trial

Subscribe to The End Game Investor to keep reading this post and get 7 days of free access to the full post archives.