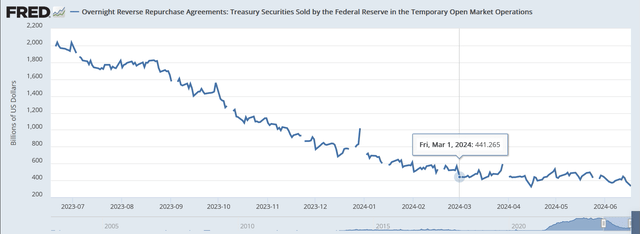

RRPs have been stable despite negative net issuance of short term T-Bills, but are now falling again by $114B since June 12, possibly related to quarterly tax deadline.

Since most financial crises happen in the fall, the RRPS zeroing out in late summer leading to shrinking bank reserves could triangulate around when crises usually happen anyway.

Yen breaks through 158 again today, BoJ just fought back once again, but even medium term the BoJ moves are irrelevant.

Myrmikan predicted QE for consumers 5 months before it happened, and called it the end game. Now we’re just waiting for the last of it to dry up.

Reverse Repos Finally On the Move Again

RRPs have not moved since March. This makes sense in context given that net issuance of short term T-Bills has been negative $144.5B since March. Despite that, RRPs have been stable, where you would have expected a slow rise for lack of anywhere else for the dollars to go. They now appear to be falling again by about $114B since June 12. We are down to $333B. It could just be a short term effect of today’s June tax deadline. We’ll see in the next few days.

We are going to have a huge drain on July 1 after the quarter end, which could bring us close to zero depending on how the rest of June goes. What happens when they zero out is that stealth backlog backdoor QE stops because the new money printed back in 2021 is no longer filtering through, and bank reserves start to fall faster. We are still around $3.4 trillion. Once we get down to $3 trillion, we should be very close to the next (and final?) crisis.

Zeroing out the RRPs sometime in July or August (hopefully) is a real possibility, setting us up for a fall financial crisis, when these things usually happen anyway.

All I can do is point out timing possibilities based on the information available. All we know for sure is that there has been no direct money printing since late 2021.

Yen Back Above 158 (Briefly), Diverging From JGBs?

Keep reading with a 7-day free trial

Subscribe to The End Game Investor to keep reading this post and get 7 days of free access to the full post archives.