Ron Paul Calls The End Game, Silver Tests $30 Again, Copper At All Time Highs

Did you know that silver tested $30 3x in 2010/2011 before the parabola to $50? Did you know that the gold to oil ratio just broke 30? Cue Twilight Zone theme. *nee-nee-nee-nee*

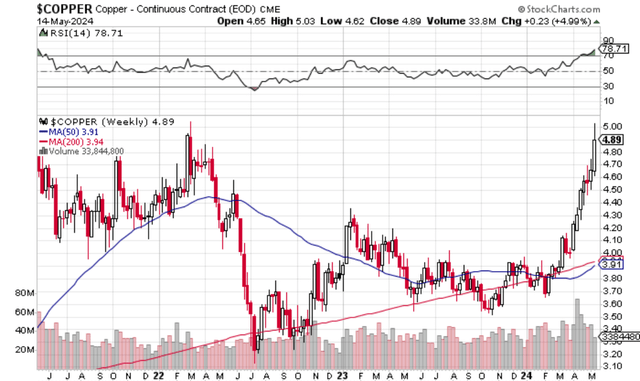

CPI is in line with expectations, though copper prices at all time highs suggest that consumer prices will not cool down any time soon.

Ron Paul predicts that the rejection of the dollar's world reserve currency status at the next financial crisis, which practically means End Game.

Silver tested $30 3x in 2010/2011, just before the parabola to $50.

Highest SLV trading volume days were when silver tested $30.

Speaking of 30, the gold to oil ratio just broke through 30 for the first time in 3 years.

CPI In Line With Expectations

CPI came in at 0.3% MoM and 3.4% YoY. These were market expectations, and now rate cuts are "back on the table", apparently.

I've been asked if I think CPI will cool down from here. I doubt it, and the reason is copper. Copper is tightly correlated with CPI because it is a measure of industrial activity and demand.

We hit a high of $5.03 yesterday, just a cent off the all time highs for copper of $5.04, which was hit on Nickelarmageddon day of March 7, 2022, when all futures markets nearly collapsed until an emergency kill switch was hit by the LME reversing hundreds of millions in trades without informed consent, as is the parlance of our times.

If copper is at prices only hit when the entire derivatives complex is in imminent danger of collapse, then no, consumer prices are not calming down any time soon.

Ron Paul Calls The End Game

Keep reading with a 7-day free trial

Subscribe to The End Game Investor to keep reading this post and get 7 days of free access to the full post archives.