Reverse Repos Plummet, And Pondering The Mysterious Yen Carry Trade

Before crap happens, gold trading volumes rise. So probably, a bunch of crap is about to happen. If only my ancestor had invented the toilet instead of Tom Crapper, Farb would be about to happen.

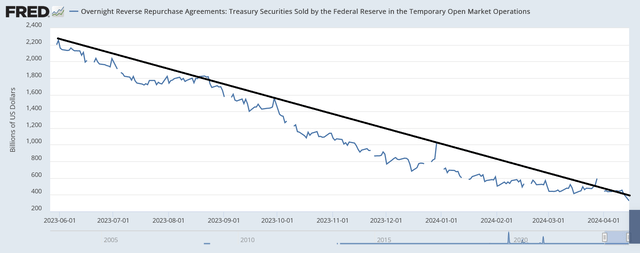

Reverse repos have decreased by $128B in the last two days, potentially reaching zero by the end of May. Banking crisis by June?

Expect high volatility in all assets leading up to the Fed being forced to print for what may be the last time.

The correlation between higher interest rates and weaker currency is becoming tighter.

Craig Hemke reveals how Comex gold futures were set up to sap demand for physical bullion citing a Wikileaks cable from 1974, 21 days before gold trading on Comex began.

The Yen carry trade may be difficult or impossible to unwind until earning profits in currency terms becomes meaningless, but I may be missing something.

Reverse Repos in The Home Stretch

Reverse repos have fallen $128B in the last two days due to Tax Day (probably). We are down to $327B. My guess is we'll drop to somewhere in the mid $200B range by the end of April, and we could zero out by the end of May.

Keep reading with a 7-day free trial

Subscribe to The End Game Investor to keep reading this post and get 7 days of free access to the full post archives.