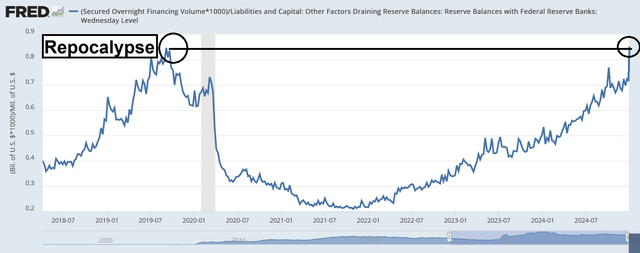

Reserves Break Below $3 Trillion Crisis Mark, Repos To Reserves Ratio Hits Critical 85%

2025 is going to be a lot of fun for banks. And by fun, I mean other stuff.

Bank reserves plummeted to $3.095 trillion, with an 85.5% repos to reserves ratio that triggered the last repocalypse.

Credit card defaults have surged to post-2008 financial crisis levels, but banks have been on a drip feed of liquidity that won't continue this year.

Expect a serious dollar crunch this quarter, with Bitcoin likely to fall sharply and gold to spike as the Fed's options dwindle.

Repos to Reserves Ratio Spikes to 80%-85%

As expected on the year end turn, bank reserves plummeted as they tend to do, flying into reverse repos to make bank balance sheets look thinner than they actually are so regulators can give them shiny stickers for being really good banks. Reserves fell to $3.095 trillion on a SOFR volume yesterday of $2.474 trillion. That's 80% of reserves trading back and forth overnight. Repocalypse zone is around 83.5% or so. 80% is slightly above the October 2nd high (quarter-end turn) of 78%, so we continue to head inexorably in the direction of a (final?) repo clog.

If we count the Wednesday level of bank reserves specifically rather than the week average, then the ratio hit 85.5%, already into repocalypse territory.

The Wednesday level is a bit misleading though because Wednesday was the year end turn itself, when banks max out their charade. In any case, reserves did fall below the $3 trillion crisis mark that correlated and I think caused the regional banking crisis. Recall though that just prior to the regional banking crisis, reserves had already fallen below $3 trillion by late December 2022. The regional bank crisis didn't hit until March. So there is a delay, but not much of one.

Keep reading with a 7-day free trial

Subscribe to The End Game Investor to keep reading this post and get 7 days of free access to the full post archives.