Rate Cuts Are Actually Quickening the Pace of Quantitative Tightening

The Fed's balance sheet is shrinking faster now because of rate cuts. Paradoxical, but true. Find out why by reading the stuff I wrote over here and such.

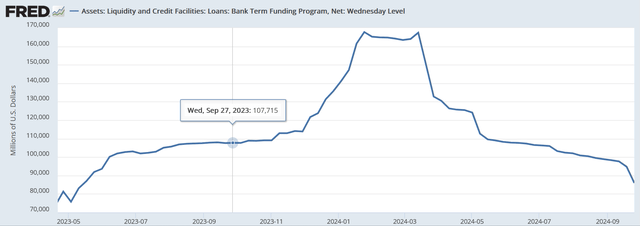

Banks are pulling money out of the Bank Term Funding Program thanks to rate cuts, quickening the pace of QT.

Gold uptrend line from 1980 peak broken a few months ago.

Number of home sales keep falling, 38 months in a row now, meaning a price crash is inevitable.

Bank reserves fall to October levels at $3.169 trillion.

Rate Cuts Have Paradoxically Quickened the Pace of QT, May Finally Drain the RRPs

I checked the balance of the Bank Term Funding Program this weekend (the regional bank bailout) and found that it fell by $9B from $95B. $86B left. I couldn't tell why, since the loans are for a year and there was no $9B surge 12 months ago to be paid back last week.

You can see on the end of the chart a fall of about $9B. Those dollars go back to the Fed and out of existence, in other words QT. Why now? I did some research and found out. It's the rate cut.

You'd expect that rate cuts would loosen monetary policy, but the 50bp cut has actually quickened the pace of QT by making it easier for banks

Keep reading with a 7-day free trial

Subscribe to The End Game Investor to keep reading this post and get 7 days of free access to the full post archives.