Rapidfire Developments

Money supply plunges post Tax Day, Japanese Rates really on the move, BOJ doesn't give a yen, more Roth diary entries from 1932.

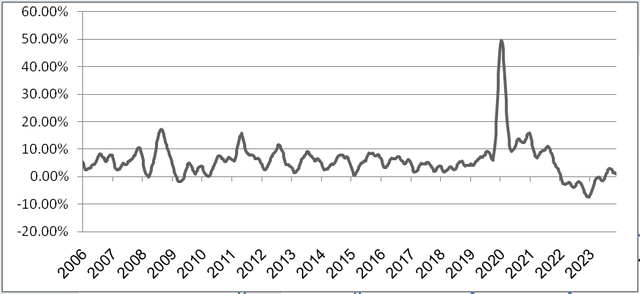

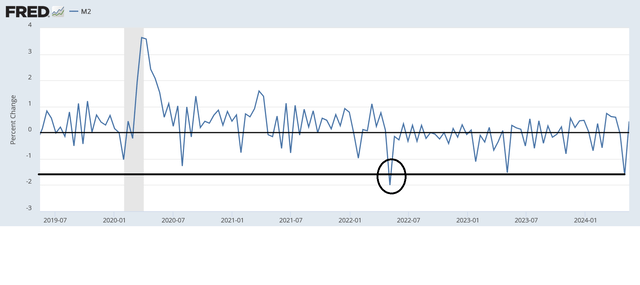

Money supply growth rate shrinks to below 1% annual, we are headed back into absolute deflation, huge M2 post Tax Day plunge.

SOFR volume continues to increase, trend higher since mid 2022.

Japanese interest rates, specifically the 10Y JGB yield, have doubled in four months, with the BOJ governor saying "rates should be set by the market".

This from the head of the BOJ, mind you.

Money Supply Growth Rate Shrinks Below 1%

We are on our way down again after the big annual post Tax Day plunge in money supply. The plunge this year was more extreme than in 2023 by percentage. We are going back into absolute deflation (money supply shrinkage) and it should last until August/September. This is going to make stocks, and the banking system of course, vulnerable. Below is the chart of M2 gyrations every two weeks. The biggest plunges are always end of April beginning of May. Only 2022 was worse than now.

SOFR Volume Keeps Trending Higher

Keep reading with a 7-day free trial

Subscribe to The End Game Investor to keep reading this post and get 7 days of free access to the full post archives.