Now THAT's A Chocolatey Short Squeeze!

A cocoa squeeze means cocoa prices go vertical until nobody can afford cocoa. A gold squeeze means the prices of EVERYTHING go vertical until nobody can afford ANYTHING. In dollars, at least.

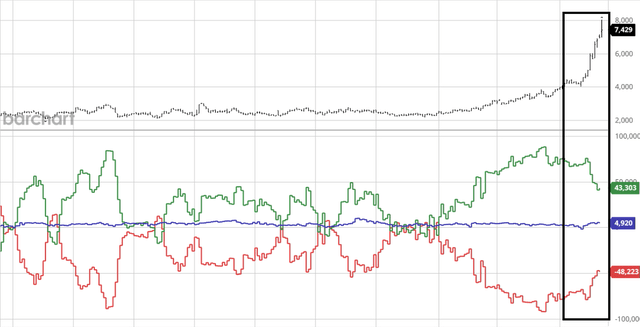

Cocoa futures experience a significant short squeeze, with prices reaching an all-time high as open interest falls.

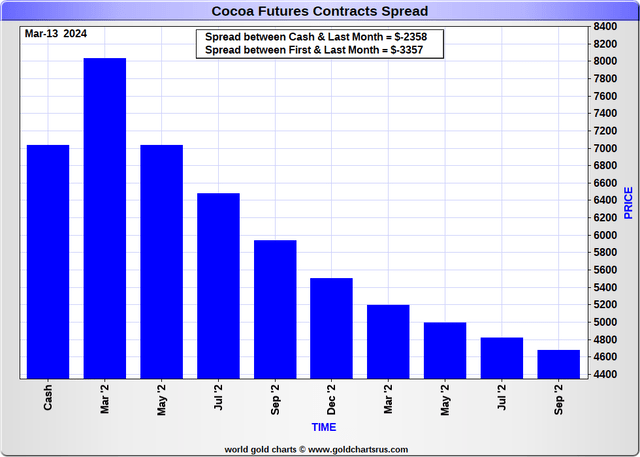

Backwardation in cocoa, coffee, orange juice, sugar, and cotton futures.

A palladium squeeze is still in the cards, like cocoa now.

My disagreement with Alan Futerman, why I think the dollar hyperinflation once it starts will not be drawn out like the peso, but will rather be lightning quick.

PPI upside "surprise" further proof we are already in the second wave of consumer price gains.

Chocolate squeeze! It's still going on as I type, cocoa futures up another 6.5% today.

Cocoa contracts short were 76,000 on January 29 and cocoa was at $4,632. Now shorts are at 48,000 6 weeks later and cocoa is at $8,000, an all time high. That's a bona fide classic short squeeze, shorts covering into a parabola by force. Is this going to cause some kind of domino like Nickelarmageddon almost did on March 7, 2022? Probably not. Don't know. But if it can happen in cocoa, it can sure as hell happen in money. The other side of a cocoa contract is the price of chocolate. The other side of a gold contract is the price every single price of every single good and service on the entire planet.

Cocoa is still deeply backwardated (prices higher for shorter deliveries).

Keep reading with a 7-day free trial

Subscribe to The End Game Investor to keep reading this post and get 7 days of free access to the full post archives.