Nobody, Neither MSM Nor Our Side, Is Reporting On Revived Record Basis Trade

All time record short positions in 2Y Treasurys is what's pushing volume in repo markets past $2 trillion a night, but we're running out of dollars to keep that going.

Gold and silver prices are rising (so far today) on both hotter-than-expected and cooler-than-expected inflation reads, indicating a turning point.

Open interest in gold is falling, potentially signaling the end of a pause and the possibility of another upward movement within weeks.

The extreme short positions in 2Y Treasury note futures, known as the basis trade, is the reason for heavy volume in repos, on collision course with shrinking balance sheet.

Gold Responds Positively (So Far) To In-Line PCE Read

It used to be that gold and silver would fall on a hotter-than-expected PCE or CPI read an the assumption that it would postpone cuts are bring forward hikes, and they would rise on cooler-than-expected reads. Now they're rising on both, which if what we're seeing today with PCE in line and gold moving up, led by the miners and silver. If any "inflation" read is going to push the metals up, then we're already turning the corner.

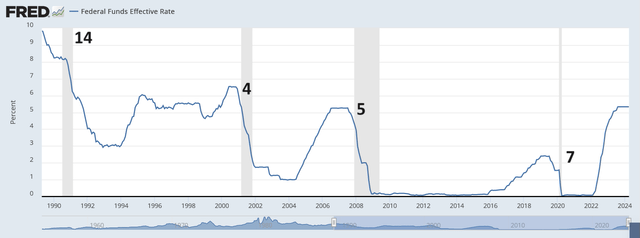

Now the consensus is forming that the first rate cut will be September. Here is a chart of the Fed funds rate with recessions marked, and the number of months from the first rate cut to recession since 1989. The average is 7.5 months.

Gold Open Interest Falls to ~450K, Could Mean Correction Near End

Keep reading with a 7-day free trial

Subscribe to The End Game Investor to keep reading this post and get 7 days of free access to the full post archives.