Money Supply Growth Falls, Fears Of No More Rate Cuts Start To Show

What they just don't get is that both hikes and cuts will make prices rise faster anyway.

I've come down with pneumonia, I'm OK and on antibiotics (unfortunately), and my mood is sour and thankful at the same time that I can breathe. I’m recovering, don’t worry.

Trading schools at war whether gold is still in a runaway move or intermediate correction. Be careful.

The growth rate of the money supply is falling again, and we are heading right back to absolute deflation.

China is signaling its intention to sell Treasurys, raising questions about their motives.

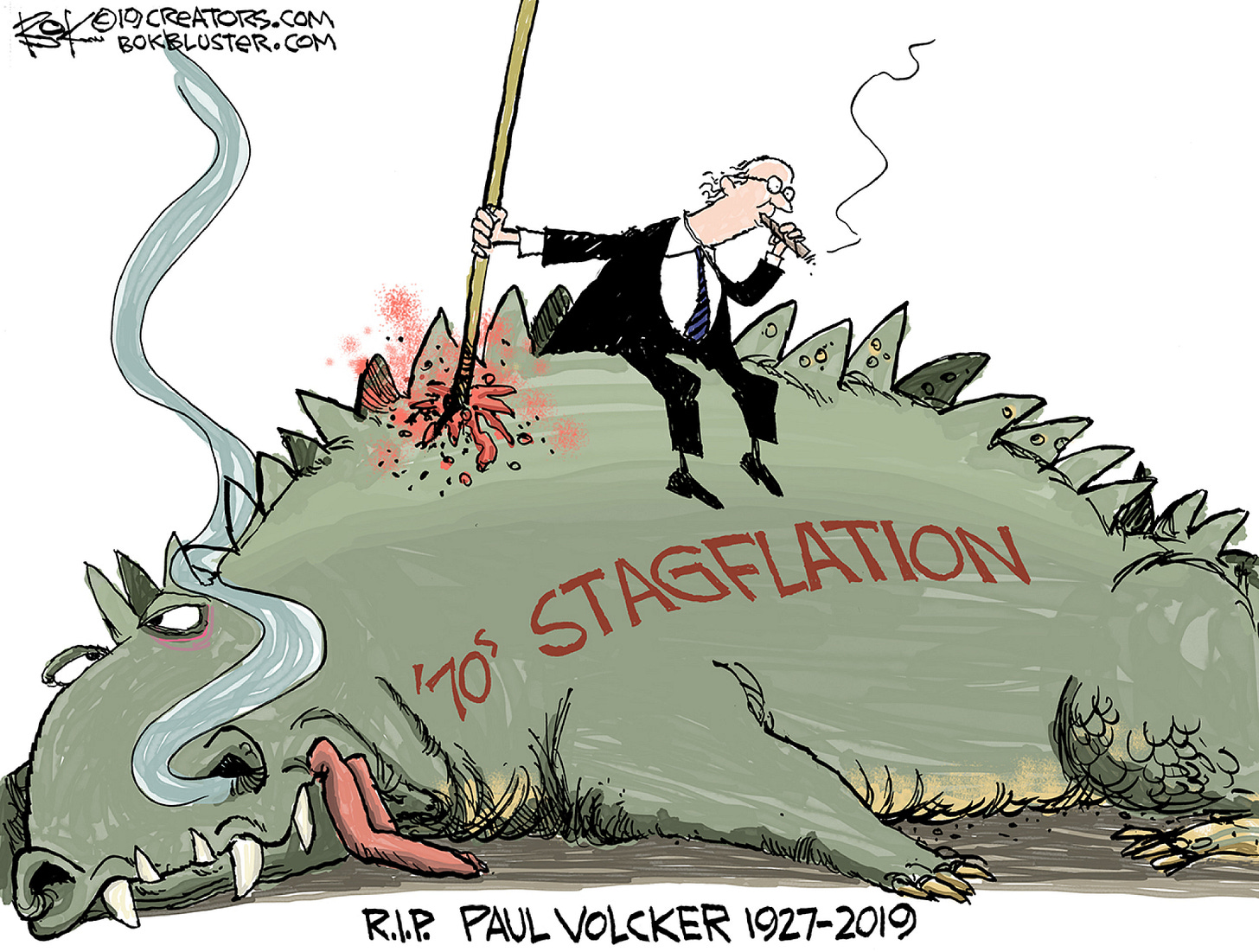

Article surfaces fearing we are already in a Volcker situation. If so, my suspicions of us being in the late 1970s are correct.

Technical War

The two techies I follow are at odds. The cyclist is convinced gold and silver are in a intermediate decline, and the historian believes that we could still be in a runaway, citing specifically 1979 as precedent. If I understood the historian correctly, he thinks we might be here:

The circle was a 6 day decline of 10%. We're currently on day 7 at 6%. I'm not saying we are in August 1979 necessarily, but I find it interesting that I'm not the only one who thinks we're in the late 1970s.

I have no opinion on which tech system is better right now. I'm just tracking it. But I will say that in the End Game, cycle trading will break down and we will repeat 1980 history.

M2 Growth Continues Falling

The growth rate of the money supply has fallen from 2.67% quarterly annualized to 1.42%. We are close to falling back in to absolute deflation.

This comes as we hit the seasonal peak of M2 growth rates into April then after tax day there's always a huge drop. The data here is on a month delay so it hasn't passed tax day yet. We should almost certainly be back into absolute monetary deflation by June, hopefully in parallel to when the reverse repos finally run out.

China Telegraphing They Want to Sell Treasurys

I'm not sure why the People's Bank would do this, announce its moves in advance, but they are. WSJ reports:

China’s finance ministry has said it is in favor of the central bank resuming trading Treasury bonds, a move that would see the monetary authority dust off a rarely used tool in its policy kit.

Officials at the ministry said that they would support the People’s Bank of China gradually restarting to trade Treasury bonds in open-market operations as they look to better coordinate the country’s fiscal and monetary policies.

The remarks, published in the state-run People’s Daily on Tuesday, come after the publication of a months-old speech by President Xi Jinping sparked speculation about whether the central bank would resort to the measure to help boost liquidity in the still-fragile economy.

China’s central bank officials haven’t made any treasury bond trades since October last year and have mostly refrained from making bond-related comments recently.

Talk amongst yourselves why China would telegraph this.

Yen About to Cross 155

The yen continues its downtrend since 2021. It's been pretty consistent.

Market Wood Finally Starting to go Limp

Couldn't resist that one. Cathie Wood's insane strategy of leveraging a bunch of tech companies into a fund is starting to reveal itself as what it is: A leveraged play on money printing. It took quite a while, but it's starting to reverse. Serves her right for her ridiculous glasses. Female money managers or financial media personalities always have to have ridiculous peacocking glasses (most, visibly without any prescription) to distract men from the fact that they're women and emphasize their intellectual nerdiness to hide their feminine features. Fine I get that, but hers are particularly offensive, just my personal opinion.

Cathie Wood’s Popular ARK Funds Are Sinking Fast

Investors have pulled a net $2.2 billion from ARK’s active funds this year, topping outflows from all of 2023.

Cathie Wood’s investors are jumping ship.

They rushed into her funds and won big during the pandemic, when the star fund manager became a social-media sensation by making bold bets on disruptive technology stocks such as Tesla, Zoom Video Communications and Roku. They largely stuck with her when the funds’ fortunes reversed after the Federal Reserve raised interest rates. Now, after years of bruising losses, many of them have had enough.

Fears of no more rate cuts surface

Ahead of the Herd published this rambling piece about how Volcker jacked up interest rates and conquered inflation. Fine, granted. But the final paragraph proved that the author has no idea what he's talking about. He concludes:

Our conclusion is that we are in uncharted territory. Everything, including gold, copper, the dollar, interest rates, and inflation is going up. It’s a trend for which there appears to be no historical precedent — apart from the fact that higher interest rates, though painful, eventually lead to the desired result of bringing inflation back into line.

My response: No, we are not in uncharted territory. In every hyperinflationary country, interest rates go to infinity. Doesn't help. There is historical precedent, 1979-1980. This time higher rates cannot conquer inflation through sheer logic, because 93% of the dollar is backed by securities that fall in value when you jack up interest rates.

What I did fine instructive about the article was less its content and more the fact that it was even positing that we could be in a Volcker situation where rates will be jacked up anyway. But the article made absolutely no mention of debt levels and how pulling a Volcker would backrupt the Federal government. There's propaganda everywhere, even in publications that are seemingly on "our side" so to speak.

FWIW, Rafi, your glasses exude just the right amount of nerdiness and intellect. 🤓

Take some time off and rest. Truly rest. That is the only way to lick pneumonia. The metals are resting; the miners are resting too (hell, they're snoring). We can wait on your next missive.