Massive Oil Bets Being Made on Both Sides On Hormuz Blockage Gamble

Yes I'm still alive and well. A bit stressed, but fine.

Worried About US Involvement

We woke up Sunday morning hearing that Trump ordered the bombing of Iran's nuclear facilities. This does not sit well with me at all, because I very much understand the exasperation of Americans (and the rest of the world) in getting involved in yet another foreign war. I have no power other than to state my opinion. I can only hope that American involvement stops here and goes no further. The End Game will happen in any case. We do not need a world war in order to trigger it, so I'd rather do without one.

Massive Oil Bets on Both Sides, Volume Rivaling Oil Crash of 2020

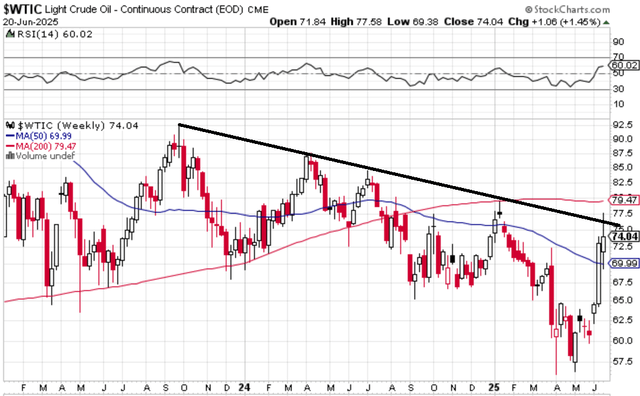

Oil prices are holding, just barely, below the trend line. By barely, I mean they are peaking through the daily chart but holding on the weekly, as you see the wick on the weekly candle on the right breaking through but not the candle itself.

Technical patterns only make sense insofar as they reflect real human emotion in relation to resources available, so what I am interpreting here is that there is an even bet on the effect of the Israel/Iran war on oil and neither side has overwhelming numbers on its side for now. This is confirmed by the massive volume in oil trading since June 13, which I'll get to in a minute.

Price wise, this is nothing compared to what happened when Russia invaded Ukraine and oil spiked to $125. Keep in mind that this Russian spike in 2022 also coincided with the nickelarmageddon fisaco at the London Metal Exchange on March 7 of that year. This time we are not seeing anything like that, not even close.

Crude oil production in Iran is about one third of Russia's at about 3.5M barrels a day. It has been more or less then same since the Islamic Revolution in 1979. Below is Iranian crude production.

More importantly, Iran's parliament voted to block the Straits of Hormuz on Friday. This is just a suggestion by them, because it's up to Khamenei to actually do it, and he's in hiding and cut off from all electronic communication. 20% of the world's oil goes through Hormuz every day, so that would be much more significant than Iran shutting down production. And still, oil is holding the downtrend line.

The fact that oil has not skyrocketed on this threat to block Hormuz suggests that markets are evenly split on whether the Iranians have the power, or the will, to actually do it.

Trading volume was near an all time record on June 13, so

Keep reading with a 7-day free trial

Subscribe to The End Game Investor to keep reading this post and get 7 days of free access to the full post archives.