MacLeod Responds, Wigglesworth Wisens, Treasury's Account Peaks, Gold Open Interest Breaks Below 450K

Overbought technicals aside, Comex gold stats indicate correction is almost over, or already done.

Alasdair MacLeod Responds Re: Basel III

On his substack, Alasdair MacLeod weighs in on the Basel III debate. It seems to me that he's basically agreeing with Keith Weiner, at least from what I can understand. Read it for yourselves and decide, but that's my take.

Robin Wigglesworth Explains the Basis Trade Succinctly and Simply

FT author Robin Wigglesworth, put together a piece explaining very simply how the basis trade works. For new readers, the basis trade is basically (pun intended) how many short positions are open in Treasury futures, and these positions are funded by repo cash, which is taken from unused bank reserves. Widdlesworth explains the mechanics perfectly. He writes:

"Let’s say you put down $10M for Treasuries and sell an equal value of futures. You can then use the Treasuries as collateral for, say, $9.9mn of short-term loans in the repo market. Then you buy another $9.9mn of Treasuries, sell an equivalent amount of Treasury futures, and the repeat the process again and again and again. It’s hard to get firm [sic] idea of what is the typical amount of leverage that hedge funds use for Treasury basis trades, but Alphaville gathers that as much as 50 times is normal and up to 100 times can happen. In other words, just $10mn of capital can support as much as $1bn of Treasury purchases."

This works until dollar funding runs out in the repo market and it all comes crashing down. Then the Fed bails everyone and everything out with trillions of new dollars. That is precisely what we are waiting for.

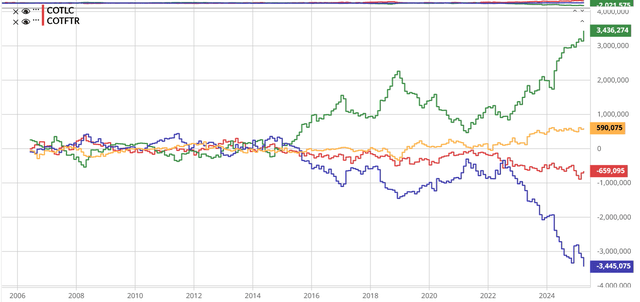

Speaking of the basis trade, it's revving up again in the 5Y Note specifically. 5Y Treasury note short positions are up a whopping 162K from last week to a new all time record high after a few weeks of moderate shrinkage. It's obscene. See blue line below:

Shorts open in 2Y futures are up 55k, though still off an all time record, though the total open in 2Y futures is about half the size as the 5Y even at peak. Meaning, the real basis trade is now mainly in the 5Y note as opposed to 2Y.

This is not going to end well when repo cash finally runs out. The ratio of bank reserves taken up by repos is still sitting at just below 80%. The last repocalypse was triggered at 83%. It may or may not be triggered at exactly that ratio, but it'll be somewhere around there.

We are really close to a repo implosion. Bank reserves are $3.209 trillion as of Wednesday, and repo volume was last measured at $2.542 trillion. A spike up to $2.7 trillion in repo volume from the current $2.542 trillion could do it, or a spike down in reserves to about $3 trillion could also do it, though the latter is less likely given the government has about $600B to dump back into the banking system now, and reserves should only come down consistently when the debt ceiling is finally raised.

Speaking of that…

The Final Plunge at the Treasury Begins

Keep reading with a 7-day free trial

Subscribe to The End Game Investor to keep reading this post and get 7 days of free access to the full post archives.