You wouldn't know it from all the lack of coverage by the world and such, but long term Japanese government bonds are at all time lows, meaning yields are at all time highs. This is the 40Y yield, all time chart:

The yield has started to climb significantly over the last 6 weeks particularly, about 100bp since April 7. The 30Y yield is within spitting distance of all time highs of 2.98%.

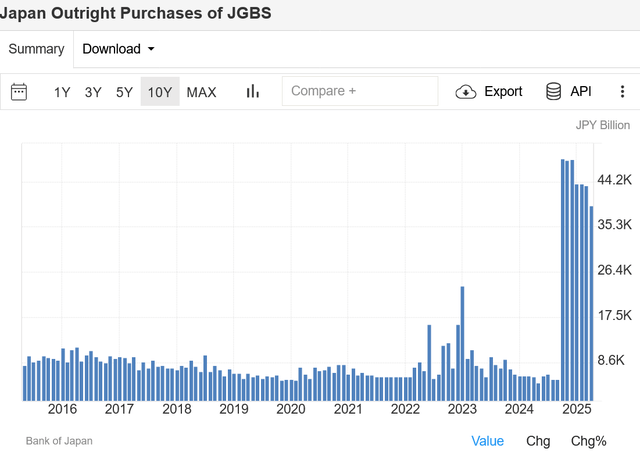

This is quite a bad sign given that Bank of Japan outright purchases of Japanese government bonds is still raging right near all time highs. If long term rate are storing despite this insane amount of monetary drugs injected right into the jugular, then Japan is very close to collapsing. Below are monthly JGB purchases by the BOJ. It's obscene. In late 2024 they went nuts apparently, and have maintained that level ever since.

LBMA Declares Keith Weiner Correct on Basel and Gold

If any more proof of Keith Weiner's position that Basel III does not change gold's status was needed, the LBMA has just come out as of May 14 and declared Keith correct. Basel III changes nothing…

Keep reading with a 7-day free trial

Subscribe to The End Game Investor to keep reading this post and get 7 days of free access to the full post archives.