It's Now Early 1923. Time For Silver Squeeze 3.

I'm making this Substack post free for all readers in an effort to get Silver Squeeze 3 started.

GLD Borrow Rate Spike Again

The rate to borrow shares of GLD spiked yesterday to a new all time high of 10.47%, and now back down above the previous high at 6.8%.

The only reason I can think of that someone would borrow GLD at such a high fee is that they need physical gold to deliver and they're using GLD as a source. Either that or some private deals are being closed that allow the delivery of GLD shares in lieu of physical promised. The amount of gold in the fund is now about even with where it was when this runaway move started in mid December.

This is still an indication, in my view, that the retail crowd is ignoring this rally still. If retail was chasing GLD, its holdings would be increasing at least on par with the price increases. The fact that it isn't is what may be causing a relative discount on GLD gold, which traders are taking advantage of even on the very high borrowing rate. I don't think delivering gold this way would be advantageous if the retail crowd were chasing the ETFs to get in on the action.

The other piece of evidence I have suggesting this is the case is that other than the South Korean mint, there have been no major reports of coin shortages at any of the retail shops. That absolutely was not the case in 2020, when there were severe gold and silver coin shortages everywhere and GLD ETF holdings went crazy. On a show with Lynette Zang this week I asked her if there have been any backups in shipping product, and she said everything flowing as normal. Low physical premiums on the retail side suggest no panic, which is why the ETF holdings aren't doing much, and in turn why it's probably worth it to use the ETFs as a delivery mechanism at this point.

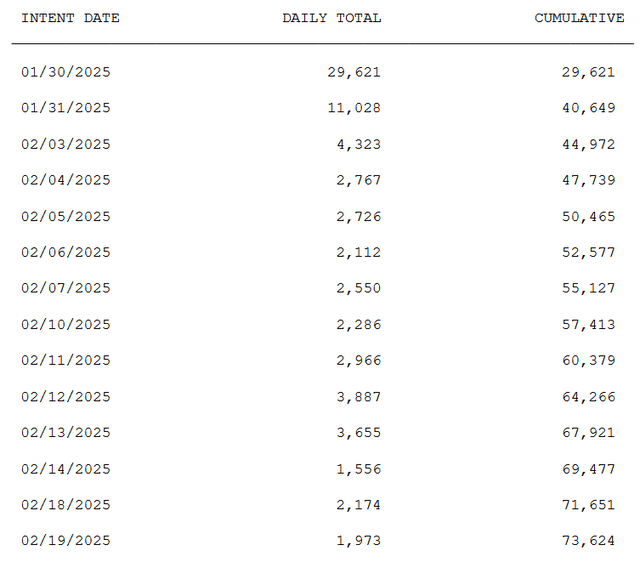

Gold deliveries continue on their merry way, now at 73,624, on track for an incredible 85K.

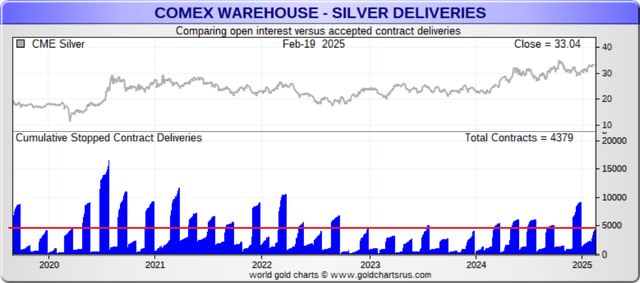

In silver, we are 6 business days away from an active contract going to deliver with over 72K contracts left open. The all time delivery record was July 2020 at 17,294 contracts. It is very likely we will break that record this March. We are seeing the same pattern in silver deliveries this month as we saw in gold last month. That is, despite current spot silver being an inactive contract, deliveries are on the trajectory to exceed the active delivery months of 2023 and 2024. (See red line below.)

This fully suggests the upcoming active March contract is going to exceed all records.

On the physical side, something interesting particularly yesterday. A net 375Koz were shipped into New York, but that includes 232K that were withdrawn from the Comex (who knows to where). All the withdrawn gold, 232Koz, came from a single vault, Brinks' 400oz bar vault. These are not 100oz comex bars. They're London Good Delivery bars that would only be withdrawn by a huge whale.

In any case, we're up to 38Moz, 2M more to go until all time high.

In silver, the flood into Comex has been nearly quadruple the speed of the 2020 flood.

Notice that the amount of silver shipped in since December is almost equal to the amount shipped in on the 2020 panic, but it's been much quicker this time. Comex is preparing for record deliveries.

I would even say that the perfect time for a new SilverSqueeze would be in conjunction with deliveries for the March contract. If successful, deliveries will have to be satisfied while the ETFs are being chased, so silver would have to go into them, and the retail market could get squeezed. I'll put out a video on it today or tomorrow.

Palladium also goes to delivery in 6 days, active contract. A physical squeeze there would be very easy to do. 10,779 contracts still open and only 761 contracts of metal are available. Palladium has also been flooding into Comex since February 1, the supply doubling from about 40K now to near 80Koz.

The record for palladium deliveries in a month is 570 from September 2020. I would not be surprised to see a new delivery record for palladium in March as well.

In the plumbing, the SOFR repo rate jumped 4 basis points yesterday to 4.37 on a jump in repo volume of $130B to $2.452 trillion. That may be due to a Washington Day 3-day weekend but I'm not sure. We'll see where we end up on SOFR today.

The Treasury's checking account at the Fed dropped by about $28B to $773B, but a whopping 77% of TGA withdrawals ($69B of $89B) were for interest payments on the Federal debt. So no, spending is not suddenly rising, but interest must be paid in full and on time.

Email From a Subscriber - It's Early 1923

An EGI subscriber send me these two pictures. Here I juxtapose them in one. The right is the gold price in paper Marks from 1919 to 1923. The right is the gold price in Euros.

The timelines are not the same, but the price action is almost exactly the same. It suggests we are somewhere around the beginning of 1923. Do what you will with this, we all know the End Game is coming. Is it really as close as these graphs suggest? We'll find out soon.

Thank you. I’ll read it another 10 times before day’s end. I can’t absorb it all at once.

Wow rafi, that was alot to unpack.

The 10% burrowing rate could have been a speed bump to limit gold withdrawals. Is there a correlation of the borrowing rate with the anticipated movement of the gold price, for example, if the borrowing rate at gld is 6.8%, is the anticipated movement in gold price around 6.8%?

I'm interested in further developments in the gld etf. So any news is appreciated.

It seems to me that as financial interests pivot to gold, they'll take a position in gld, as they have not fully embraced the value of holding physical. I imagine the march to the end game will see a bubble develope in gld. Your thoughts?