Is JPMorgan End Game Prepping? And Subscriber Bitcoin Question Answered

JPM is stuffing its vault with gold like its 2020 again. I think Jamie Dimon sees what's coming. And why bitcoin is a dollar derivative, answered.

I Think JPMorgan has Begun End Game Stacking

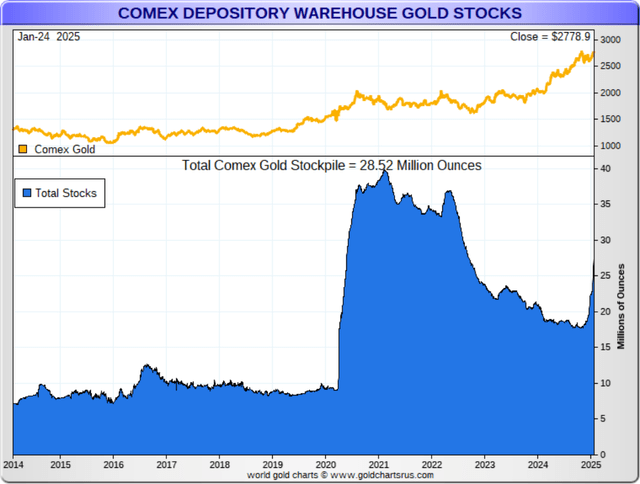

The flood of gold into the Comex continues. It's looking a lot like 2020 all over again. I've been thinking it over, and now I'm not sure how much this has to do with possible imminent tariffs on gold imports. Tariffs may have something to do with it, but it sounds to me like the "establishment" explanation, something that has some truth to it but does not really explain the magnitude of this flood.

Also realize, the increase comes before the major deliveries for the active February contract set to deliver on Thursday. There are still 219K February contracts open. All time record deliveries occurred in June 2020 at 55,102 contracts, concurrent with massive flows into the Comex vaults, led by JPMorgan, more on that in a second. We may break that record in 4 days and see the strongest monthly flow into the Comex ever this February.

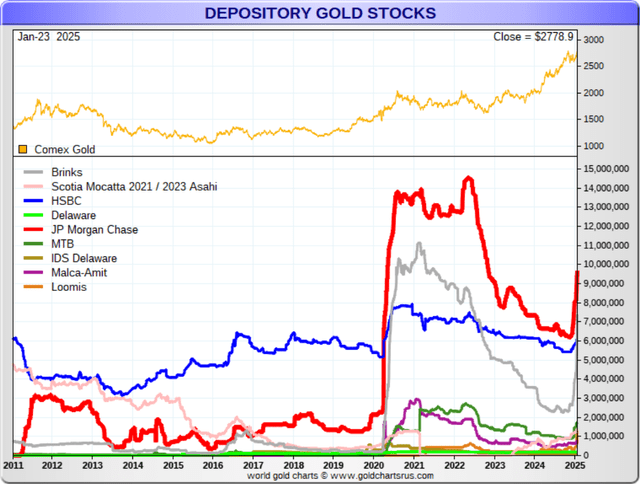

The last time we saw a veritable flood of gold into the Comex, the two main culprits were JPMorgan and Brinks, and to some extent HSBC. Brinks is used by many third party actors. JPMorgan is also, but when the bank itself wants to make a huge move for whatever reason, they use their own house account into their own vault.

GoldChartsRUs has a very nice chart showing those responsible for the gold flood of 2020, and the same three parties are up to it again, in the same order. My guess – while tariffs may have something to do with this situation to some extent, I think something much bigger is going on here. My guess is that someone high up at JPMorgan sees a banking hiccup approaching and is preparing accordingly, and others are following the leader.

(I'm pretty sure that the thick red line is JP Morgan but I can't be absolutely sure. The MTB and JPM lines look the same to me. Please forgive me if I'm wrong.)

What does JPM see exactly? The hint comes from Daniel Oliver of Myrmikan Capital. In his latest research, he points out:

Keep reading with a 7-day free trial

Subscribe to The End Game Investor to keep reading this post and get 7 days of free access to the full post archives.