Initial Signs of Gold Short Squeeze?

Canada May be the First to Fall in the West, Bank of Japan Frets and Sweats, and Gold to Commodities at Crossroads

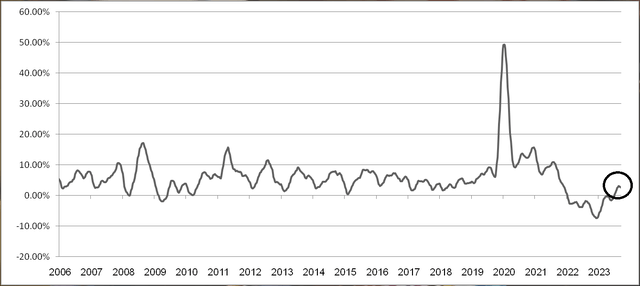

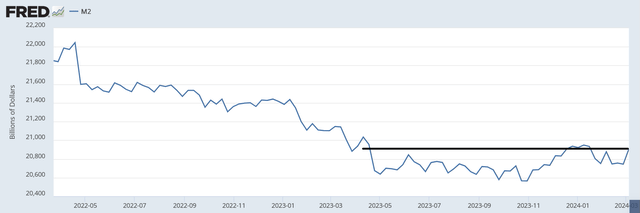

Money supply growth rate is falling and is expected to continue slowing, potentially leading to deflation by summer.

Repo rates start to rise into quarter turn, BoJ frets about Yen, Canada wriggles and writhes.

Gold showing initial signs of potential short squeeze as open interest falls and prices rise, while silver is at a two-year high in open interest.

Money Supply Growth Rate Falls

The spurt in money supply growth is over. I will predict that it will not come back until the next round of printing starts.

We actually peaked at 3.14% annual on February 5th, so the monetary inflation rate has been slowing for nearly 2 months now. By summer we should be back in absolute deflation at a time of intense quantitative tightening due to the BTFP loans being called in plus regular QT ongoing. It's going to be difficult (maybe impossible) to get through the summer without some new inflation cranking.

Looking at the absolute numbers week to week, the end-of-month jump into March was unable to exceed January M2 levels. The peak will be late April as it always is (except for 2020), and we'll head down hard from there into August.

Here Comes The Repo Stress

Keep reading with a 7-day free trial

Subscribe to The End Game Investor to keep reading this post and get 7 days of free access to the full post archives.