I'm Still Alive, Reserves Plummet, And QT Accelerates Further

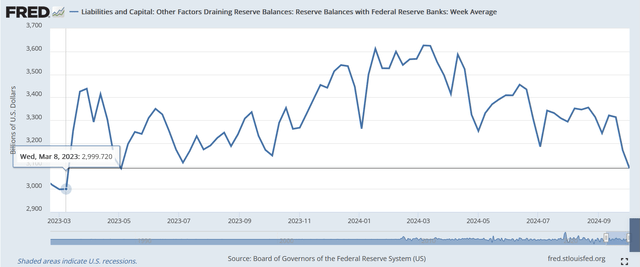

Bank reserves are down to $3.089T as higher rate loans are paid down thanks to the recent rate cut. Repo rates stabilize but repo to reserves ratio still above 70% thanks to falling reserves.

a few sirens over the weekend, some shaking, but no real damage. Medevac helicopters overhead and lots of noise.

Bank reserves plummet to low not seen since regional banking crisis, probably due to loans being paid with reserves because rates on loans are higher than rates on reserves.

Basis trade and gold shorts update.

10Y-3M yield spread approaches normalization.

Still Fine Up Here

I was offline for 3 days due to Rosh HaShana, which began Wednesday night and ended Friday night into Shabbath, so I had no idea what was going on in the world for three days, which is like a year in today's world. There were a few sirens and the neighborhood across from me got hit by falling shrapnel from an interception. Plus there was a long line of military helicopters that flew above us, most likely medical evacuation for wounded soldiers. So far the official numbers are we have lost 8 soldiers and Hezbollah is down about 500, and Israel has reportedly blown up huge amounts of missiles hidden underneath buildings in south Beirut in a suburb called Dahiah, which literally means "destroyed" in Hebrew, go figure. (I'm not joking.)

Plus Nasrallah's replacement Hashem Safi Adin has been eliminated, along with IRGC head, the late Qassem Suleimani's replacement, an idiotic general named Qaani who decided it was a good idea to visit Lebanon specifically now, so he's dead, too.

Back to the choppers, I'm not sure why they were flying over us since we're on the Syrian side to the east of the Sea of Galilee, not the Lebanese border, unless Israel has also invaded Syria without admitting so officially. This is likely, since there are Iraqi and Yemeni divisions amassing on the Syrian border as we speak and they have to be dealt with, like, now.

The problem now as I see it (my war vision is nowhere near as keen as my monetary vision so for what it's worth) is that we have so decimated Hezbollah already that they have almost nothing to lose from continuing to take potshots at us and keep the 80,000 northerners from returning home. Therefore, the only thing they can actually lose is territory, so they're either going to stop shooting rockets, or Israel is going to have to conquer land and hold it and settle it, in order to end this war.

There is no other option as I see it. Eventually we'll get there. I don't know how long it will take but that's where it's going.

How this fits into the End Game is obvious. Sooner or later we are going to attack Iran's oil infrastructure. The latest I see it happening is after the US election, but it could be any time now. Iran has said they are going to respond by attacking the oil infrastructure of Azerbaijan, Saudi Arabia, the UAE, and other US allies and countries loosely allied with Israel (not sure if Iran can even pull this off at all), and then this basically becomes World War III out in the open. Not responding hard to Iran's ballistic missile attack, even though it was essentially toothless and not much more than a lame fireworks show, will embolden the foreign divisions sitting on our borders, so not responding is not an option if we want to, you know, stay alive and stuff.

For those interested in understanding more of the details of what is going on in my head, for better or worse depending on your weltanschauung obviously then this is a very good summary featuring head of the Zehut party, my former neighbor Moshe Feiglin, in English. It's very End Gamey.

Now, back to the monetary picture, which has evolved quite a bit since Wednesday.

On the Precipice of the Final Crunch

I reported last week on the Bank Term Funding Program speeding up QT due to the BTFP loans now having a higher rate than the rate paid on bank reserves. Therefore it makes sense for a bank with a BTFP loan balance to pay it back early with either bank reserves or reverse repos. Either way those dollars leave one of the two facilities, go back to the Fed and go out of existence, which is QT.

Well, the BTFP drained again this week by $14.473B, up from $8.843B last week. So yes, it's draining faster now and should continue. In parallel, bank reserves fell hard by $79B this week $79.5B, down to the critical level of $3.089 trillion, the lowest since just before the regional banking crisis.

The question I asked myself when I saw this is why would reserves drop by $79B if only $14B or so was paid back from the BTFP? My guess is

Keep reading with a 7-day free trial

Subscribe to The End Game Investor to keep reading this post and get 7 days of free access to the full post archives.