Gold:Silver Spikes To 100, Stocks Near 2020 Crash Levels Relative To Gold

And bank reserves are about to plummet by about $450B as tax day arrives, which would put them below the $3 trillion crisis threshold.

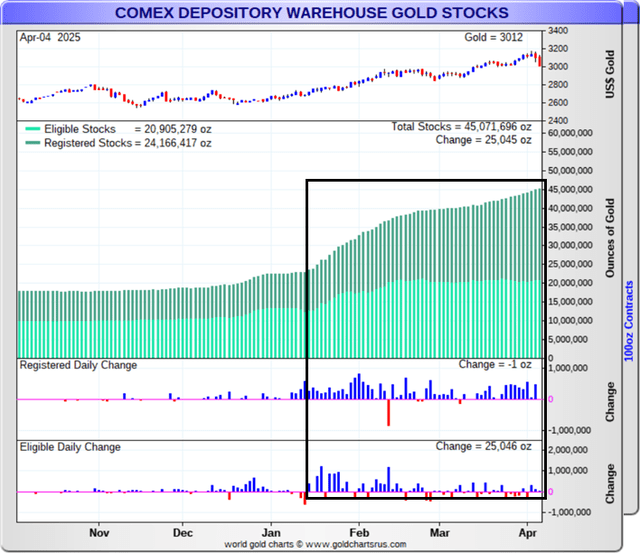

Proof the Gold and Silver flows Have Little to do with Tariffs

My current thinking on the sell-off in gold and silver is that the exemption of tariffs on bullion has caused a lot of the tariff-fear buyers to sell. While I don't think the tariffs are a big driver of the gold price, there is probably some amount of buyers on the margin that are selling now because of the tariff exemptions Trump gave to bullion. I think they have been cleared out already, or close to it.

First, if we cross-reference the selling to when gold and silver started pouring in to New York and the price started to seriously rise, we can see that the last two days of selling haven't made much of a dent. Meaning, if people were buying gold because they were afraid of tariffs and that is most of the price move, we would expect that on news that gold is exempt from tariffs to erase much of that price advance. And yet it hasn't.

You can see below that the influx of gold started in mid January, when fears of tariffs on gold and silver supposedly started to spread.

This is the price since mid January:

When the gold flows into New York started, we were at $2,660. The current selloff hasn't even broken through the $3,000 level, which only a few days ago was seen as a groundbreaking high.

Second, we have the open interest situation. Open interest in gold futures has already collapsed to 465K contracts, below where it was when the rally coinciding with the gold flows into New York started. Meaning, there are fewer longs now than there were then, and that probably means most of the weak holders have already been flushed out.

We could continue to fall to around 450K or so, but I don't think we'll get much below that without a full blown liquidity crunch and banking crisis, and the current selling is not that. If it were, we'd see the dollar index spiking, and instead it's falling. Even in a full blow dollar crunch, open interest probably will not fall below 400K or so, the 5Y low area.

Finally, if tariffs were at all responsible for the flow of metal into New York, we would expect those flows to reverse, or at least to stop, on news of the exemption. But they haven't stopped. Inflows have continued over the last two days since the selloff began, especially in silver, which has gotten badly hammered. Silver just saw an inflow of over 5Moz yesterday into storage (not for sale), the second biggest daily inflow of eligible silver since the flood started. (See black horizontal touching the current daily bar in eligible. The biggest inflow into eligible came mostly from registered, so it wasn't a big net gain into New York that day anyway.) If silver flows continue this strongly, the flow has little to nothing to do with tariffs.

Meanwhile, Gold is Rocketing vs Stocks

The selloff looks mean but it's an illusion, just like 2020. In fact

Keep reading with a 7-day free trial

Subscribe to The End Game Investor to keep reading this post and get 7 days of free access to the full post archives.