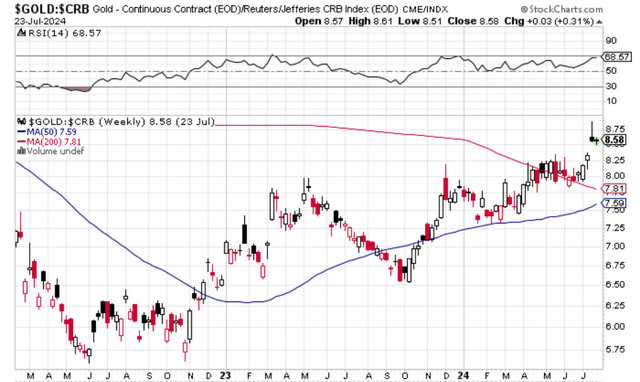

Gold Pulling Away Vs Commodities, Golden Cross Imminent, Happened Only Once Since 2008

It seems like a small deal, which is why nobody talks about it, but it's not that small of a deal. Too many are hyperfocused on the dollar price when that doesn't matter so much.

Gold is gaining momentum in real terms compared to other commodities, with a potential golden cross on the horizon.

SOFR rates remain elevated still, volume holds above $2 trillion.

The yen is strengthening as the Bank of Japan depletes reserves, potentially through selling dollar cash, no sign of swaps with the Fed since July 11.

Gold Interest Programs, Fractional Reserve vs Honest

I was speaking with Phil of the Bitter Draught on Rumble yesterday, and he was asking me about a company that offered to pay interest to its clients holding gold with said company. I won't mention names here since I haven’t done the research personally on this company. Apparently though, it is offering interest on gold held with it. It could be legitimate, but what raises flags to us is that this interest is offered without locking up the gold as a time deposit.

There is no problem with earning interest on a time deposit. That is how banking should work. It is not fractional reserve and it is not inflationary. On a demand deposit, that's a different story. Depositors should be paying to store anything as a demand deposit – wheat, oil, gold, dollars, whatever. But as a time deposit, interest should be earned because it is being loaned out for that time, hence unavailable for withdrawal for the term of the lease. The interest is paid in return for the risk of losing the time deposit, which is rare but not impossible. A company earning interest but keeping all deposits on demand, I can only conclude logically that it is fractional reserve, and Phil agrees.

This differs from Keith Wiener's company Monetary-Metals, which I am now partnered with, after much consideration. If you click on that link you'll get to their silver bond offering which earns 12%, in silver, for accredited investors only. The silver loan is being issued to the silver miner Bunker Hill, details at the link, and will be paid back in silver out of Bunker Hill's production.

For regular investors, Monetary-Metals offers low-risk leases of between 2.5% and 5% interest on gold and silver deposited with them. The gold or silver is locked for the term of the lease, meaning it is not a fractional reserve loan, and all gold that is sold by a company (usually a jewerly firm) using the lease, is immediately purchased back, minimizing risk.

I asked them, and in the case of emergencies, it is possible to liquidate metals before the lease term is up, provided that another client offers to take your place in the lease. This is usually the case, since leases are limited and demand is high. It takes several months for gold or silver deposits with Mto be fully leased out, which means there is a waiting list. In the mean time, once gold and silver are deposited, clients pay no storage fees.

So on the one hand, it's not magic – you don't automatically start earning interest immediately as you would in a fractional reserve scheme, but if you are interested in earning on your gold and silver in an honest way rather than paying for storage or holding it all at home, then I'd say Monetary-Metals is the way to go. I don't hold all my stacks with them obviously, but for a fraction of it, for me it is a wise move to offset storage costs elsewhere, as well as the risk of home storage.

Despite the Nominal Pullback, Gold is now Gaining Momentum in Real Terms

Relative to commodities that is.

The last two weeks, with gold pulling back from a high of $2488, have looked like a correction. Nominally, very minor but there. I think it will continue for another few weeks or so, but as this is happening, gold is pulling away in real terms. In other words, all commodities are pulling back now, and gold is pulling back less than all the others.

Keep reading with a 7-day free trial

Subscribe to The End Game Investor to keep reading this post and get 7 days of free access to the full post archives.