Gold Miners Finally Break Out Of Massive 13-Year Triangle, And The Yen Sistine Chapel

And Bank of Japan made a valiant attempt to break the Yen's downward trend line yesterday, but failed on the border.

Miners break out of 13-year triangle, potential liftoff in trading range.

Miners have been crap since the 1980s, nobody will trust a sustained rally, much fuel for prolonged bull market from here.

A word on the CPI, and yesterday's gold rally was exclusively focused on futures. ETFs did not participate, nor did physical markets.

That makes me nervous short term. Open interest exploded to highs not seen since March 2022 nickel LME explosion.

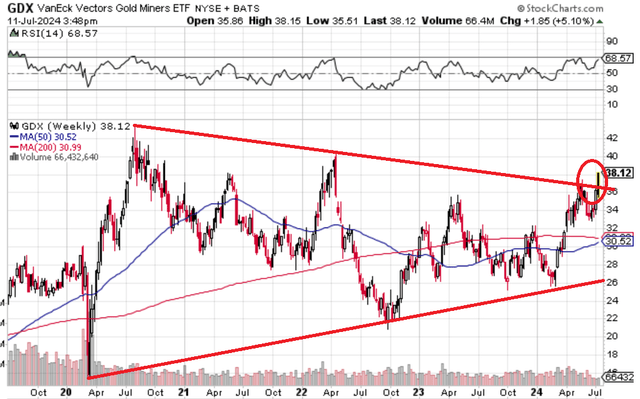

Miners Finally Break Out of 13-Year Triangle (Wedge?)

Since I'm not a technical trader, I'm unsure if this is a "triangle" or a "wedge". (Or maybe a "wedgie"?) Either way, all wedges are triangles, geometrically speaking. Whatever, point is, we have potential liftoff in miners after a very long and frustrating road.

By liftoff I mean escape velocity to a new trading range. This does not mean that we won't have one final plunge during the next (and final) banking crisis, but that will be ephemeral, if scary. On the medium and long term charts, miners are finally looking very exciting. Here's the medium term, since 2020:

Here's the long term, since 2011, same triangle, now broken through to the upside.

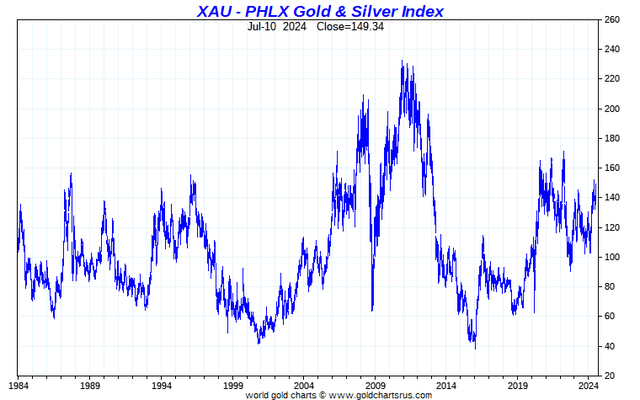

Plus, we are within 47¢ of a golden cross, 50WMA above 200WMA, has only happened twice before in GDX specifically. (It's a very young fund.) It last happened during the breakout of 2019, which was a great time to buy. In 2016 the golden cross didn't amount to much though, so it's not a perfect signal by any means. Still, miners have been crappy for pretty much the entire gold bull market since 2000, and even since 1984 with the inception of the XAU index, which has not moved on net since then.

This is not going to last forever. It's been 40 years, as long as the last bond bull market and the Japanese stock bear market. It will end when bubble stocks deflate and mainstream investors finally realize they cannot outrun inflation with tech and bitcoin. Nobody sells at the top. All those with 10x gains from the Nasdaq will lose most if not all of their gains by the end of this mess, or worse.

As tech deflates, bonds won't be an option, people will pour into resource stocks in a commodity boom, gold and silver miners among them. Once it starts it will be fast and furious, and unchaseable emotionally.

Can you imagine how much skepticism there will be when miners really start to move? After 40 years of range-bound trading as gold went up and up? Nobody trusts them. Everybody laughs at them. The perfect fuel for a prolonged bull market. A wall of worry like El Capitan.

A Quick Word on CPI

The CPI falling 0.1% is surprising. That miners responded so strongly to it though (on the theory that the Fed will now cut a measly quarter point in September, which will accomplish nothing insofar as preventing the final banking crisis) means that when the Fed must cut back down to zero overnight (which will happen, mark my words), the metals and the miners are going to explode, probably with a record breaking day or week from gold and silver equities.

And I have a feeling that just as tech and bitcoin responded negatively yesterday to the Fed probably cutting by September, they will also respond negatively (in gold terms for certain, and probably even in nominal terms) to emergency cuts.

Gold Futures Open Interest Explodes to new Cycle Highs

This is making me short term nervous. The bullish action in gold yesterday was reserved almost entirely in the futures market. The ETFs barely participated at all. SLV lost holdings and GLD barely added anything. Retail investors are still AWOL, and we can see this in the tiny physical premiums. This is bankster action going on now, and other institutional futures traders, maybe family offices. Open interest exploded by 30,092 contracts yesterday, reaching highs of just under 560K contracts, the most since March 2022 Nickelarmageddon LME fiasco.

Those that opened longs in futures yesterday are in danger of being whipsawed out. I've seen these kinds of wild moves in open interest many times before and they almost always mean the longs are being set up. Doesn't mean it's definite, but I'd be careful here if you're trading. As always, if you're stacking, it makes little difference, since premiums are so low now anyway and will compensate higher for a lower spot price.

Yen Surge Yesterday

Despite yesterday's Yen surge to a 157 handle, the dying currency is still on trend line for 2024. BoJ definitely intervened according to "Asahi TV" (whatever that is) according to Zerohedge. They were trying to maximize the effectiveness of their intervention by conducting a yen-buying operation on a surprise low CPI read when the dollar was going to sell off in response anyway. Despite their best efforts though and the opportune time to sell dollars for yen, the BoJ could not push the yen decline below the 2024 trend line. All they could do was touch it. Reminds me of the Sistine Chapel.

https://internationalman.com/articles/david-stockman-on-what-romes-currency-debasement-tells-us-about-the-future-of-the-us-dollar/

I assumed Asahi TV was part of some giant conglomerate that included Asahi Refining but apparently they're completely unrelated. Anyways I like Asahi silver rounds, nice design