Summary

Open interest in gold futures surges AGAIN, another 20,000+ new contracts open yesterday.

The super wealthy and big banks are heavily involved, while the public remains unaware and uninterested.

Gold and silver physical premiums are falling. SIFMA publishes new report on Treasurys.

The total gold value of the money supply remains constant until the End Game when it falls to zero.

Open interest in gold futures continues to rocket higher fast. Another 20,232 contracts yesterday were opened, and we're up to 507,564. That's almost 100,000 contracts in 6 trading days.

That's going from a 5 year low to a 1 year high in a flash. OI almost never climbs this far this fast. Something big is boiling, and only the super wealthy and the big banks appear to be involved in this.

733,000 ounces of gold have been sucked out of paper funds this week alone, as gold futures head higher day after day. I don't know exactly what is going on but somebody or some group of people is making a very big bet and they're going all in, while the public seems completely unaware.

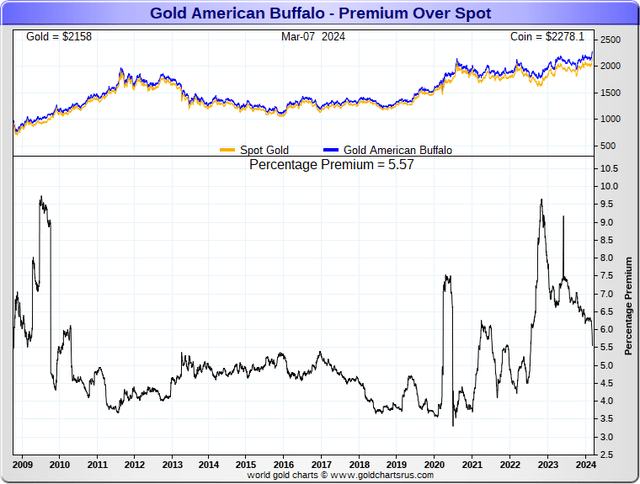

Gold physical premiums are falling hard.

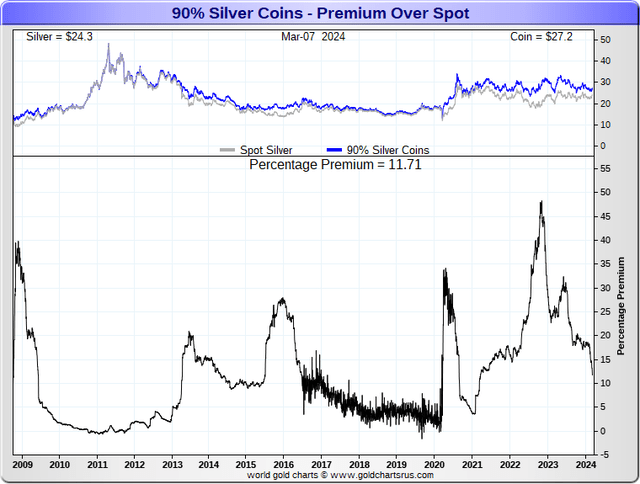

So are silver premiums, junk silver down to 11.7%.

Whoever is buying, it's not stackers.

New SIFMA Report Out

Keep reading with a 7-day free trial

Subscribe to The End Game Investor to keep reading this post and get 7 days of free access to the full post archives.