Flushed Pyramid Toilet "Winnings"

The inverted financial pyramid from hell won't fall over. But it will flush down.

Signs suggest that the commercial mortgage crisis is close to blowing up, spilling into Europe now.

Deutsche Bank, the G-SIB, that the pyramid cannot survive without, is at the highest exposure, surprise surprise.

Fund managers point to CMBS as their biggest worry.

Ugly 20Y auction, QT restarts, and Druckenmiller goes long gold stocks.

All in all, it's a frustrating time. It looks like the inverted pyramid is once again being reinflated. That means everything on top of the base inflates back up. That includes stocks, bonds, even bitcoin, which are all way up there on the structure. Purchasing power gets sucked out of real money and back into derivatives, until the next pin pokes the top layers, and the purchasing power flows right back down again, into money ultimately. This is why, since 1971, gold is still outperforming stocks. Because the truth cannot be hidden.

That next pin is coming, and I think it will be persistently higher price inflationary readings, hurting Treasury prices until commercial mortgages or some similar distressed asset class triggers a crisis and the Fed buys everything.

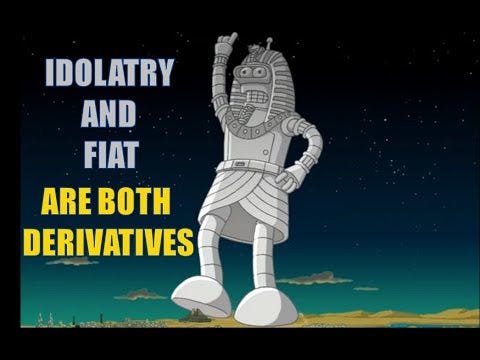

In one of my earlier videos, I explained that the pyramid we are all watching won't exactly topple over.

More accurately, it will flush down.

To paraphrase Idiocracy (which is what this godforsaken pyramid has built), "Like from the pyramid toilet." The bottom of the purchasing power bowl is gold and silver, and all purchasing power that is now being housed in the upper layers, will not simply disappear. It will simply be flushed down into the lowest layers. So it's not a question of missing out. It's rather a question of delayed gratification.

For those who can get to the end of this, it's not about getting rich. That's just a side effect. It will be up to us to rebuild with our flushed pyramid toilet winnings, to put it crudely.

CMBS Crisis Break Out?

Multiple signs suggest that the commercial mortgage crisis is close to blowing up, my guess some point soon after the bank term funding program expires and the bulk of bailout loans must be paid back.

Keep reading with a 7-day free trial

Subscribe to The End Game Investor to keep reading this post and get 7 days of free access to the full post archives.