Fed Standing Repo Facility Proven Impotent As Usage Falls To ZERO Despite Repo Rate Surge

There can be a gold unicorn, but what would a gold rainbow even be? The sound of one hand clapping.

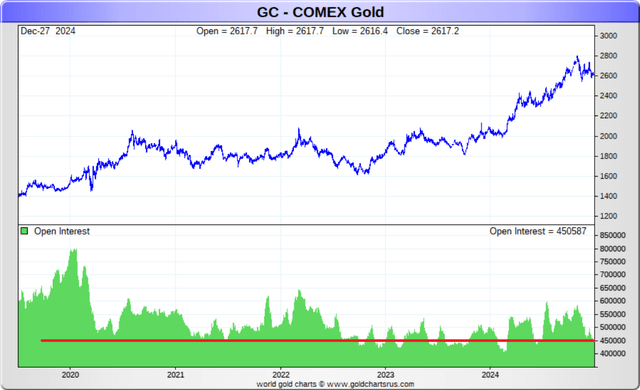

Gold's open interest has fallen below 450K, indicating limited downside potential for prices even if there's another dash for cash.

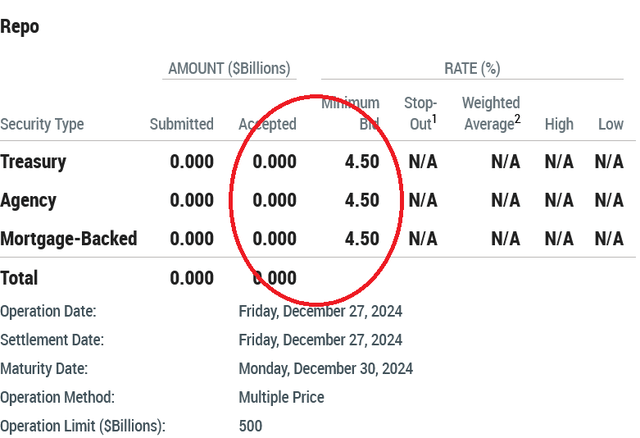

Reverse repos surged by $72B, highlighting cash tightness and the inefficacy of the Fed's Standing Repo Facility to stabilize rates.

The repo market is on its own, with rates likely to exceed the upper bound by at least 100 basis points on January 2nd.

Gold Open Interest Breaks Below 450K, Price Steady

Gold is still showing it doesn't want to go much lower. Open interest broke below the 450K mark yesterday and price is pretty steady. To give a bit more perspective on this number, it is already below the low hit post March 2020 crash when every financial institution was scrambling for dollar cash as the global economy was being shut down by the most benevolent geniuses the world has ever known. See red line below, you'll see it's below the 2020 open interest low.

My point is, if there is another dash for cash – and there will be - open interest in gold is already pretty low, so price doesn't have much that much room to fall from here.

Reverse Repos Rise Another $72B

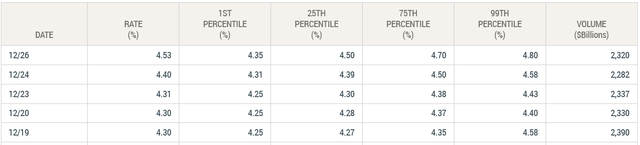

We're approaching the clog climax. Still three days to go. (SOFR data is on a 24hr delay.)

The SOFR rate on 12/26 waqs 4.53%, above the upper bound of 4.5%. Today was down a bit to 4.46%, which surprised me since reverse repos were even higher by $72B from Friday, but it seems the tightness in cash is being reflected in stocks today rather than in the repo market. We still have the 30th, 31st, and January 2nd until the pressure maxes out then subsides)

A few things to consider: The Standing Repo Facility [SRF], which is the Fed's offer of cash for Treasurys for bank that need it on standby, appears to be completely and utterly useless. If it could be used at all, it would have been tapped Friday by the vast amount of financial institutions above the 25th percentile who borrowed cash above the repo rate that was offered by the Fed, see below:

The SRF had zero volume today as well, even though the75th percentile and above were all above the upper bound.

Bloomberg's monetary plumbing correspondent (I guess that what she is)

Keep reading with a 7-day free trial

Subscribe to The End Game Investor to keep reading this post and get 7 days of free access to the full post archives.