Fed Now Openly Worried About Stagflation, Dollar Tests 14Y Trendline, Gold to Commodities Nears Breakout

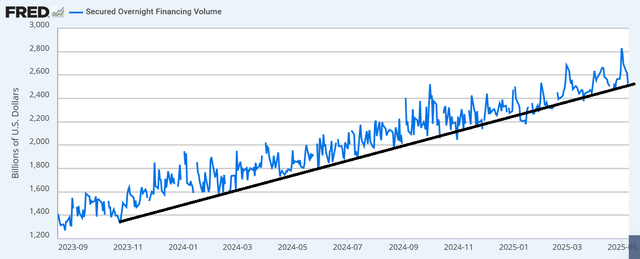

And an update on the repos to reserves ratio...we're still near critical at 82%.

The Fed never uses the dreaded word "Stagflation". That's a vulgar curse word in Fedspeak. Almost as rare though, is them predicting stagflation with more diplomatic language. Stagflation, of course, is the confluence of higher unemployment with higher consumer prices, what the Fed misleadingly calls "inflation". This, they actually did predict in the last FOMC statement:

The Committee seeks to achieve maximum employment and inflation at the rate of 2 percent over the longer run. Uncertainty about the economic outlook has increased further. The Committee is attentive to the risks to both sides of its dual mandate and judges that the risks of higher unemployment and higher inflation have risen.

If the Fed is openly stating that "the risks [of stagflation] have risen", then we can be sure it's coming. Stagflation is the best possible environment for gold, and when it gets strong enough, will wake up silver as well.

Repo Volume Likely Bottoms at $2.535T as Ratio Still Near Critical

Below is repo volume, with my trend line in black. You can see we have tagged the trend line again after the end of month spike to $2.835T. You can see that we have only very rarely ventured below the trend line, point being that repo volume has likely bottomed here.

The repos to reserves ratio using the week average is

Keep reading with a 7-day free trial

Subscribe to The End Game Investor to keep reading this post and get 7 days of free access to the full post archives.