Evidence is Building That the Fed And Treasury Are Conscious of the End of the Line

Treasury plans to raise $450B this quarter, nearly the exact peak of the reverse repo facility since September 2024. I think they know how much room they have before they break something.

It looks like the Fed and the Treasury are aware of how much cash they can raise without triggering a crisis. Either they are EGI subscribers, or I'm onto something. If we start to see out-of-place Futurama references in speeches given by the Secretary of the Debt, then we can be sure it's the former.

Why do I say this? In a new and revealing piece in Bloomberg, monetary plumbing correspondant Alex Harris quotes some firm named Wrightson ICAP about what they expect the Treasury's cash raise is going to be in the immediate aftermath of the debt ceiling raise. Here's the relevant quote (my bold):

Wrightson ICAP expects the Treasury to issue roughly $450 billion in net bills during the third quarter — far below the $1.1 trillion issued in the same period two years ago, following the suspension of the debt ceiling in June 2023.

Front-end investors will be closely monitoring the Treasury’s efforts to rebuild its cash balance at the Federal Reserve, as the influx of new bills is expected to drive yields higher across a range of instruments, from Treasury-backed repurchase agreements to agency debt.

More broadly, market participants will be watching for signs of disruption, as the rising Treasury cash balance draws excess liquidity out of the financial system, potentially prompting the Federal Reserve to intervene if bank reserves fall too sharply.

Wrightson projects that the Treasury’s cash balance will return to its typical range of $800 billion to $850 billion by October. While this would represent a meaningful drain on bank reserves by that point, the impact is expected to be limited in the near term, given that reserves currently stand at approximately $3.26 trillion, according to the latest Federal Reserve data.

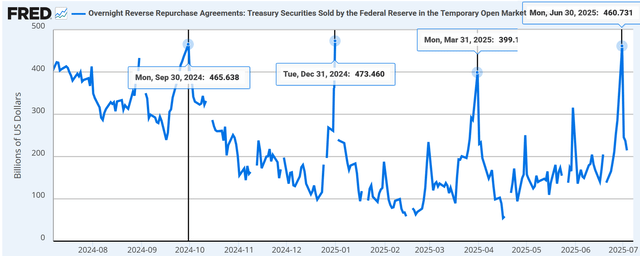

Remember when I said that the recent peaks in the reverse repo facility were showing that there was about $450B of extra cash sloshing around this system? The logic is that if the RRP keeps peaking at around that number on quarter and month-ends since September 2024, then that is around how much extra liquidity exists, and by extension this is about how much liquidity the Treasury can draw out of the system before something rips, or tears, or breaks, or implodes, or flabarginates, though I'm not sure what the latter means, it sounds appropriate.

You can see above the recent peaks in the RRP. So is it a coincidence that the Treasury will raise about that much cash his coming quarter in the wake of the Big Beautiful Bull? Maybe. But maybe somebody over there knows how much room, or around how much room they have before they wreck things.

The question now is what happens once they finally drain the damn RRP, and we have a hint of what happens in the paragraph below, from the same article:

“We currently expect that transition [to QE] to take place in the early part of next year, but the Fed would not hesitate to accelerate the timetable if the projected contraction in reserve balances in September and October creates visible frictions in the overnight market,” Crandall wrote.

The reason they're saying frictions in September and October, I think, is that they expect the Treasury to raise about $450B through August, which will bring the RRP down to zero, and then the frictions will start between the Treasury and all the other firms competing for the same dollars for their basis trades and such.

To me it looks like they know how long the runway is, and they're going to coordinate on how deal with the end of the road as delicately as they can. Until something happens that they weren't expecting and everything goes to hell. What that will be exactly, we'll find out when we get there. And then it'll look so obvious in retrospect we'll all question our intelligence as to why we didn't see it.

Japanese Ultra Long Bond Yields Rise Fast Again

Keep reading with a 7-day free trial

Subscribe to The End Game Investor to keep reading this post and get 7 days of free access to the full post archives.