Dumb Cheap Accounting Tricks Will Not Stop The End Game

And a bit on monetary symbols for incest.

I’m making this post free because I don’t believe in dollars anymore. Really for other reasons like I think this point is important and shouldn’t be paywalled, but I thought the whole not believing in dollars thing sounded more noble.

Financelot, who I follow on X, is generally pretty cool, except he gets this point very wrong. I quoted it, objected, and he responded to me, so hopefully I can get him on the channel. We'll see. Anyway, he says thusly thus:

"If everyone is selling U.S. Treasuries at fire sale prices, the U.S. will simply buy up all of its own debt with the skyrocketing Dollar. You can't default on your debt if you own most of it, thus resetting the cycle of U.S. debt being the most stable & valuable in the world."

I responded thusly this:

I’ve never heard Financelot be more wrong. Dollar collapses with treasuries because the dollar is backed by treasuries. If A=A, then A-100=A-100. Currencies only rise with rising interest rates if the central bank that issues the currency hasn’t been performing monetary $€% acts on itself for 16 years. Draw me an AI of that one.

Note the awesome use of monetary symbols for incest. You've got to give me credit for that one. I really am that much of a genius.

But to the non-incestuous point, Financelot may be technically right in terms of dollar numbers, but he's absolutely wrong about the last part of the claim: "thus resetting the cycle of U.S. debt being the most stable & valuable in the world."

No, not so much. US debt will still be worthless after that. Buying it back will not reset everything in the US government's favor. In order to understand why, let's take the most extreme case of what Financelot is suggesting. He's suggesting the value of the US debt falls to the point where the Federal government has enough dollars to simply buy all of it. That is theoretically possible, but it also means hyperinflation and the end of the entire fiat monetary system.

Let's assume interest rates rise so much and the value of Treasurys falls so catastrophically that the Federal government can buy all of its debt for $1. Does that reset the cycle of US debt to the most stable and valuable in the world? Not anymore than you defaulting on all your credit cards and loans resets your personal credit core to the most stable and valuable in the world. It resets it for sure, but nobody is going to lend you any purchasing power after that at any interest rate. Not for a very long time at least.

But let's build this out logically a bit more. If the value of US debt falls to the point where the government can buy all of it back with cash on hand, everybody loses every dollar they have on deposit at any commercial bank, because deposits are backed by US Treasurys. So anyone with deposits has no purchasing power.

If the value of US debt falls to the point the government can buy it back with cash on hand, that means the Fed's balance sheet, which is literally what backs the dollar itself, is complete toast, because something like 93% of it is Treasurys. Meaning, even those who have dollar cash have almost zero purchasing power.

When purchasing power leaves one class of assets, in this case dollars, it does not disappear. It merely shifts. In this case it shifts to real assets, the most liquid of which are, dun-da-na-nah….gold and silver.

In order to build up another debt scheme after you default, you need real assets to lend, not more debt. So the debt cycle cannot simple restart itself without the US pledging something real, which would be gold. Even if they can, it will take a long time for another debt pyramid to be built, decades at least.

In a narrow sense, Financelot is talking about hyperinflation without realizing it. In a broader sense, Financelot's problem is an expression of a much more pervasive sin against economics as a discipline of logic. Economics is the study of scarcity and choice. That means there are a finite amount of resources on the planet and we have to choose what needs and wants to satisfy and which not to. There is no escaping this. There is no Etz Hayim (Tree of Life) available to us at the moment and we do not live in Gan Eden. Resources have been consumed and wasted. They are gone. This is a real, physical reality.

What Financelot is positing is a false magic trick. He's saying that all of the massive malinvestment and waste of resources that the world has committed and accumulated since 1913, all of this is entirely reversible by an accounting trick. That there's this walla wave of the arm technical stunt that the US could do when its debt becomes worthless that will enable to maintain its station as the most powerful, fiscally dominant nation on Earth. That this magic trick if "genius" in his words and planned and diabolical and something that "not enough people appreciate" because it's so cleverly awesome.

I assure you with as close to 100% certainty that I can muster, this is not the case.

The trick he is proposing is dumb, redundant, ritualistic, retarded and worthless.

Yes, technically speaking, the US can theoretically buy back its debt and be debt free. Great. Hyperinflation and actual honest default accomplishes the same thing with the basically the same consequences. It's all completely meaningless and inconsequential exactly how, in a mechanistic sense, worthless debt is technically liquidated. Once it's worthless, it's as good as liquidated anyway, because nobody wants the crap. Whether you pay the debt with a few scraps of worthless paper or a lump of dog$#!+ makes no difference.

The US buying back its debt would be like paying a flat rate mortgage after hyperinflation with fistful of trillion dollar bills and saying that solves everything yay. What's the point? At that point the bank doesn't give a crap and it won't come after you, because your mortgage is worthless and just keep the damn house and leave the bank alone. The real issue is that the bank is dead and everyone who held money there has lost all purchasing power. So you got away with a flat rate mortgage and everyone else who relied on the bank is now bankrupt and starving. Where's the genius?

On the scale of the United States, it's not one bank but all economic actors who own any dollars anywhere on earth. It cannot be solved by a cheap accounting trick. The fall of US debt means, by definition, that all the lost purchasing power of that debt is transferred into real assets, the most liquid of which are, and always have been, gold and silver.

End Game QED.

Treasury's Account Starts to Drain

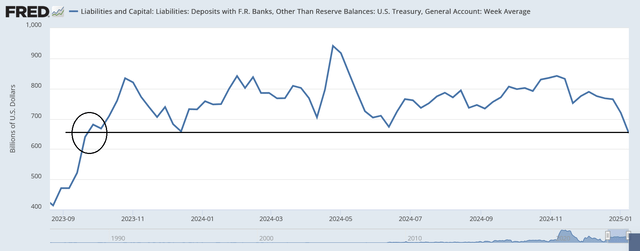

The Treasury's checking account at the Fed [TGA] has started its drain into bank reserves. We have hit the lowest level in the TGA since September 2023, indicating T-bill sales are slowing down and the Federal government is now spending down its cash balance.

Alex Harris, the repo reporter at Bloomberg, believes that bank reserves will rise because of this. In my opinion they won't rise significantly because the fall in the TGA (non-reserves into reserves) will be matched by the rise in RRP on the other side (reserves into non-reserves), but we'll see what happens and who's right. I don't think it makes much of a difference because either way, reserves will fall hard once the debt ceiling is raised anyway, according to both of us.

Meanwhile, reserves are back up to $3.254T after the year-end plunge, thanks to RRP and the Treasury's account falling back down. You can see the movement at this table from the H41 Fed Balance sheet report:

From here I expect reserves to stay more or less stable until the debt ceiling is raised, my guess around March. Then we'll hit the banking crisis.

Interest Rates Rocket, Higher Highs Confirmed

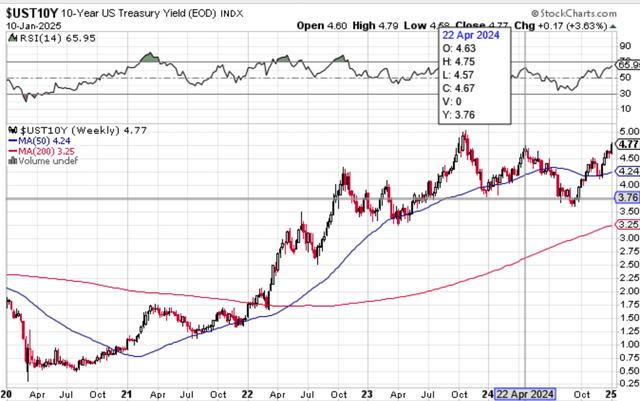

A better than expected jobs report is what's being blamed for the 10bp rise in 10Y yields on Friday. Whatever the proximate cause, the truth is that dollar-denominated debt is losing value and as it does, gold will have to compensate for that lost value as it did in the late 1970s when debt lost value, except this time there will be no recovery because the debt is way too big to ever regain its value again as it did after 1981.

In the chart below you'll see the 10Y yield has now confirmed a pattern of higher highs, surpassing the April 2024 high of 4.75%. We could possibly have a pullback in yields to around the 50WMA, now at 4.24% and then another advance.

Wolf Richter, who I can safely say is not a moron, notes "I’m not sure we’ve ever seen anything like this before – a 114-basis-point surge of the 10-year yield while the Fed cut by 100 basis points – but there’s a good reason for it.”

First of all, we have seen something like this before, but not as tight, in 1974-1975.

In the rectangle, the Fed cut the Fed funds rate [blue] by about 770bp and during that time the 10Y yield (red) rose by 85bp. This time it's a much tighter correlation with a 114bp rise in the 10Y and only a 100bp cut in the fed funds rate, so Richter is right we haven't ever seen anything this intense but my point is something like it has happened, and it happened during the worst stagflation scare in dollar history. This one will be much worse than 1974.

Bitcoin Starting to Wobble Again

The break of the double top in Bitcoin vs gold continues to prove only marginal, which technical schools would call a marginal double top breakout reversal. Or something like that. We are coming up on support at the March 11, 2023 high. Bitcoin is probably the least stable "asset" in existence, and I use the term "existence" here very, very loosely to include "imaginary construct of mass formation psychosis". Which, in today's day and age, I guess can be considered an asset and such and has made many people disgustingly rich, whether you're the CEO of Pfizer or some bitcoin hodler inadvertently helping Bourla by keeping the dollar alive.

If the Fed would start catching all of the falling knives of U.S. bonds as they were tanking it would be the sucker trade of all sucker trades. The bonds would all be worthless even before they finished and no one would ever buy another U.S. bond. The yields would go to infinity on a zero value bond: 0⁰⁰.

What is zero raised to the power of infinity?

Zero. And the currency would therefore have the same value i.e., ZERO.

Hi Rafi, I hope you and your family are safe and well. Lance Morrison - new subscriber