Douchy Bank Regulators Gunk Up The Repo System Because Bank Stocks Are Too High

They're insisting that $560B in available repo dollars not be offered on the year end turn for regulatory reasons involving capital ratio blah blah flark.

Comex Gold, Silver, and Palladium Deliveries Today on Active Contracts

Quick comex update. Gold, silver, and palladium all go to delivery today on active December contracts. I'm not expecting any fireworks but let's see how many warrants switch hands. I will be expecting fireworks on deliveries when gold gets locked in backwardation and nobody wants to roll over to the next contract anymore because they want to cash out of the dollar casino. We’re not there yet, but elevated deliveries would suggests Comex market players are getting more nervous and less trusting in paper contracts.

Fed Mulls Cutting RRP Rate by 5bps

Bloomberg reports that the Fed is considering cutting the reverse repo [RRP] award rate by 5bps to match the bottom of the lower bound of the fed funds rate. Right now RRP earns 5bp more than the lower bound. First, I'll quote Bloomberg, then tell you what I think is really going on, and then why I think that.

“Lowering the ON RRP offering rate five basis points would align the ON RRP offering rate with the bottom of the target range for the federal funds rate and would probably put some downward pressure on other money market rates,” according to the minutes of the gathering ended Nov. 7.

The current rate for the RRP is 4.55%, which sits about five basis points above the bottom of the Fed’s policy target range of 4.5% to 4.75%.

Officials last tinkered with the tools when it raised the rate on the RRP facility in June 2021 as a dollar glut in short-term funding markets outstripped supply of investable securities and weighed down front-end rates, despite the steadiness of the Fed’s key benchmark. At the time, there was $521 billion in cash squirreled away at the overnight RRP facility.

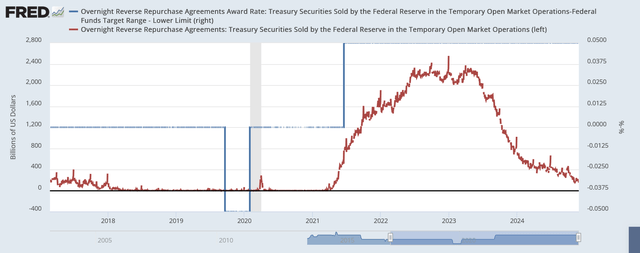

I kajiggered this chart showing reverse repos in the red (left scale) versus the spread between the RRP award rate and the Fed's lower bound in the blue (right scale). It was basically zero until June 2021 when the Fed was trying to incentivize more dollars to flow into RRP because there was way too much liquidity squishing rates and threatening to push them negative, which would have been, like, bad for hyperinflationary reasons and such. So they upped the spread to 5bps, where it is now.

What I think is really going on is the Fed is considering trying to squeeze the rest of the liquidity stuck in RRP out of there and back into the banking system, by tinkering slightly with the award rate. They are probably starting to get concerned that rates are too high and that the system is running low on dollar grease and that maybe we could have a surprise viscosity breakdown. (Because when your viscosity breaks down, what's next?)

Why do I think they want to coax the rest of the RRP dollars out? Because of this:

Keep reading with a 7-day free trial

Subscribe to The End Game Investor to keep reading this post and get 7 days of free access to the full post archives.