Crazy Shenanigans In Comex Gold, Platinum. MacLeod Takes Notice.

It was either an attempt to stage a run on New York, pushed back by the brokerages, or it was a systemic glitch. My bet is the former.

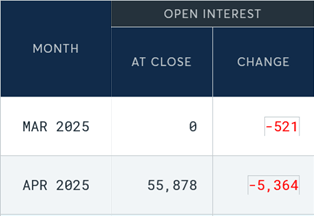

On Friday, as I reported in the last EGI, open interest in April gold closed at 55,878. Then, some time on Monday, those numbers were revised way up. That happens sometimes because the first publication is not final. But I've never seen a revision this extreme before. This is Friday's revised numbers for April gold.

For reference, this was the screenshot I posted on EGI on Monday, reporting the same numbers.

Nearly 51,000 contracts were opened on that revision, whatever it was. Then they were immediately closed. Here are those numbers, for March 31.

A fall of 87,848 contracts. If we subtract the number of deliveries (each delivery closes one contract) we have a fall of 52,983 contracts that were closed without delivery, even more than supposedly opened the day before. They were either cash settled or sold on the open market.

Or…they never existed.

I don’t know what's true.

I'm trying to follow what Eric Yeung is saying about the debacle on X, and to be honest I can't make any sense of his commentary. I like the guy, but I think in this case either I'm just thick or he's trying to sound like he knows what he's saying when he's not really sure.

Alasdair MacLeod also tried to make sense of it on his Substack, and though I don't know if his theory is correct, at least I understand what he's trying to say. He mentioned me. (Though having twice misspelled my name now, maybe it's a British autocorrect or something. My great grandfather farbed things. He did not fab things. Whatever either of those German/Yiddish verbs are.)

Keep reading with a 7-day free trial

Subscribe to The End Game Investor to keep reading this post and get 7 days of free access to the full post archives.