Countdown To Debt Ceiling Raise Begins - 10 To 12 Weeks

And real estate is cheaper than at any time except 2011 and 1980. Housing prices are not rising. It's all an inflationary illusion.

Above is the latest balance for the Treasury. It's been a fall of $78B a week average over the last 5 weeks. That's 5 weeks until we run out of cash, but tax day will hit in about 3 weeks and net about $200B or so, or about another 3-4 more weeks of cash runway. So we're talking about 10-12 weeks until the debt ceiling must be raised, at this rate anyway.

Reverse repos are headed back up as Daniel Oliver predicted since there are not enough T-bills to absorb the cash. They're now hanging consistently at about $200B, up from a low of about $60B. They'll have to be drained as well once the ceiling is raised.

Gold is holding its gains vs stocks despite the bumpiness in the dollar price over the last few days.

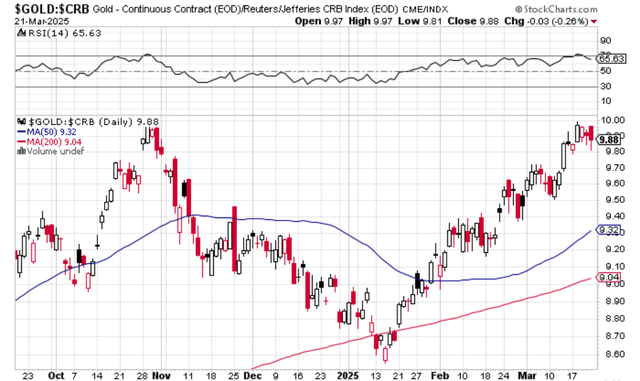

Its also holding its gains vs commodities.

Versus commodities it's not surprising there is some resistance at this local top from back in November last year.

Bitcoin to gold ratio holds below trendline and below the 50WMA. Bad sign for hodlers.

Basis Trade Reviving

Keep reading with a 7-day free trial

Subscribe to The End Game Investor to keep reading this post and get 7 days of free access to the full post archives.